Market Review 22/10/2021

EUR/USD

EUR/USD has been trading within the range of 1.1540 and 1.1685 over the past few weeks currently meeting matching the price of its 200-period Moving Average. Traders will likely be monitoring today’s PMI (Purchasing Managers’ Index by Markit Economics) data releases on the Eurozone, as these have been declining after the 15-year peak from July.

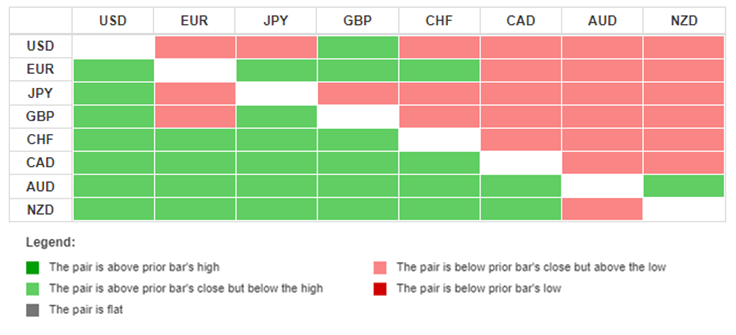

Currency Heatmap

The Currency Heatmap shows how the Australian Dollar seems to have gained momentum positioning as the relatively strongest currency across the panel agains its major peers followed by the New Zealand Dollar, which has been taking that tittle over the last week. The US Dollar falls on the other side of the spectrum as the worst performer.

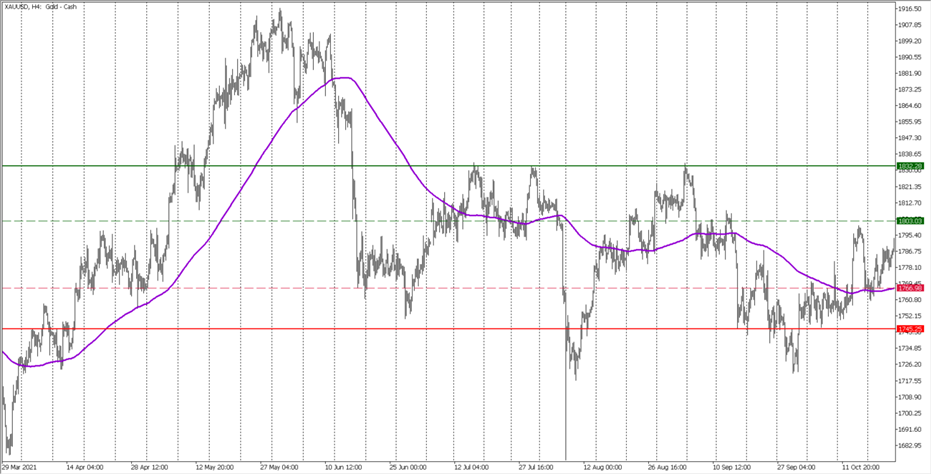

Gold

Gold seems to have gained momentum during this week after last Friday’s selloff. Price has been rising helped by a weaker US Dollar making the precious metal to trade avobe its 200-period Moving Average, currently up 1.50% for the week while this Market Review is being written. If this uptrend keeps strenghtening, we could see a test against the key level of USD/oz 1,800.

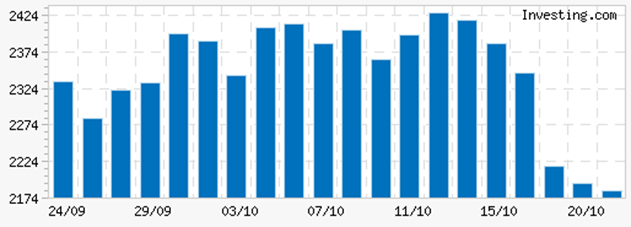

*Source Investing.com Calculator

Volatility has reduced significantly over the past week after peaking above 2,424 points a week ago. Its current levels (around 2,174 points) makes a reduction of approximately -10.31% in relation to last week’s maximum level.

Stocks to Watch

Earnings: Below are the stocks to monitor for the rest of the week will announce their earnings.

| Friday, October 22, 2021 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | Time |

| US | Honeywell | 1.99 | 8.65B | 153.12B | Before Market Open |

| US | American Express | 1.77 | 10.54B | 140.86B | Before Market Open |

| US | HCA | 3.96 | 14.52B | 79.61B | Before Market Open |

| US | Roper Technologies | 3.83 | 1.61B | 49.98B | Before Market Open |

| US | Schlumberger | 0.3563 | 5.94B | 48.3B | Before Market Open |

| US | VF | 1.15 | 3.5B | 28.86B | Before Market Open |

| US | Ventas | 0.0488 | 914.66M | 21.99B | -- |

| US | Regions Financial | 0.5259 | 1.56B | 21.54B | Before Market Open |

| US | Royal Caribbean Cruises | -4.13 | 612.15M | 21.51B | -- |

| US | Seagate | 2.21 | 3.11B | 18.33B | Before Market Open |

| US | InterContinental ADR | 0.2033 | -- | 12.61B | Before Market Open |

| US | Cleveland-Cliffs | 2.21 | 5.69B | 10.5B | Before Market Open |

| UK | InterContinental | 0.2033 | -- | 9.14B | Before Market Open |

| US | Gentex | 0.4013 | 445.43M | 8.72B | Before Market Open |

| US | Autoliv | 0.8197 | 1.89B | 8.26B | Before Market Open |

| US | Boston Beer | 4.26 | 531.88M | 6.22B | After Market Close |

| US | Goodyear Tire & Rubber Co | 0.2353 | 4.86B | 5.36B | -- |

| US | Altra | 0.824 | 473.4M | 3.63B | Before Market Open |

| US | Salisbury | 1.5 | 11.8M | 148.13M | -- |