Market Update 12/10/2021

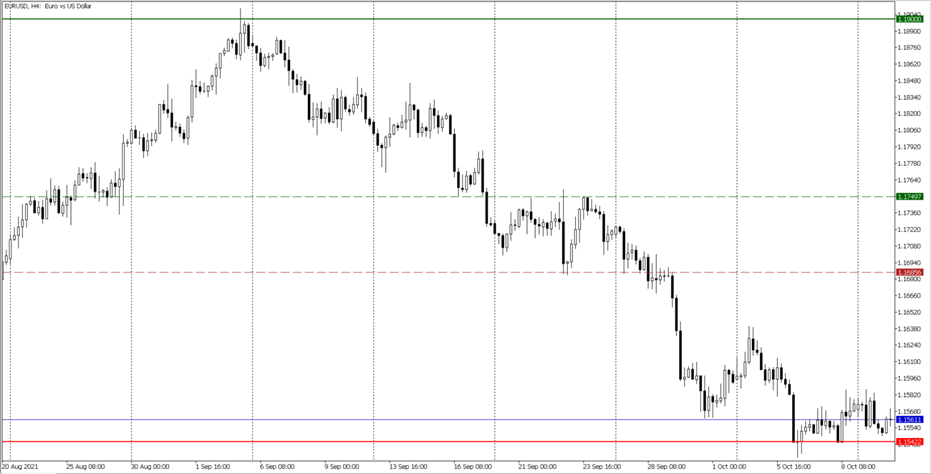

EUR/USD

The Greenback continued to strengthen against the EUR during the last week, breaking through the support level of 1.6885 that marked the lower end of the range where the pair was trading despite of NFP numbers falling short of the expectations for the second consecutive month. It seems that the pair is stabilizing around the 1.1540 level for now. We keep the 1.1900 figure as our strong resistance, as per last week’s Market Update.

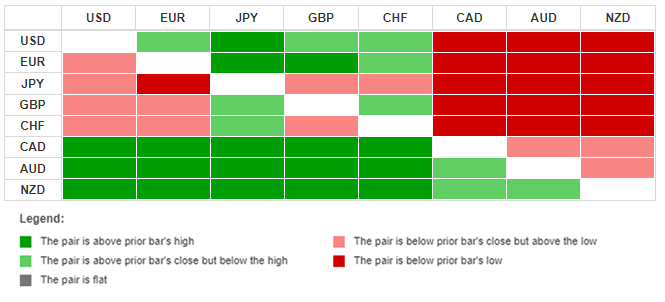

5 Hour Currency Heatmap

The 5-hour currency Heatmap illustrates the continued strength of the Canadian Dollar, Australian Dollar and New Zealand Dollar, with the latter showing to be the relatively the strongest against all other major currencies. The Japanese Yen is showing the most weakness against the other pairs in the recent days.

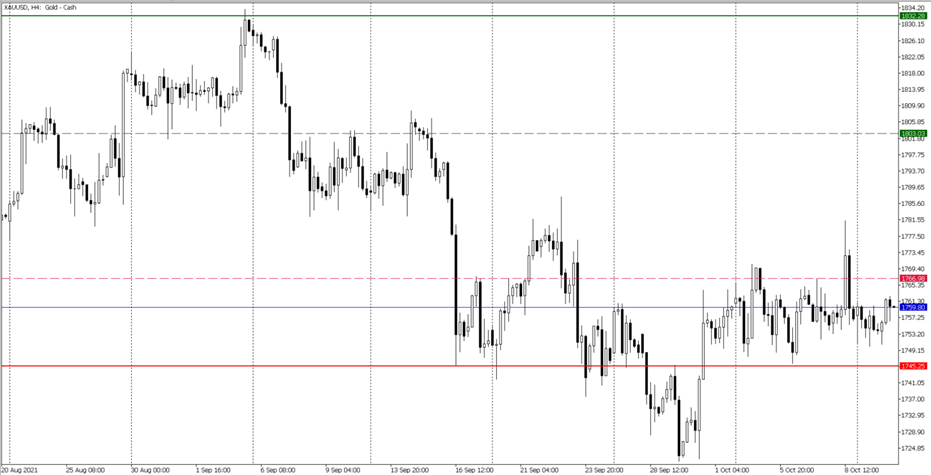

Gold

After testing the USD/oz 1,745 level during the last two weeks of September, Gold broke through the resistance reaching the lowest point since August just to bounce back above it to continue to trade within the 1,745 – 1,766 range. We keep consistent with our vision of the USD/oz 1,800 as a key psychological resistance level for Gold. The next key level of resistance continues to be at the USD/oz 1,832 level; a break of this may see gold rise in the longer term back.

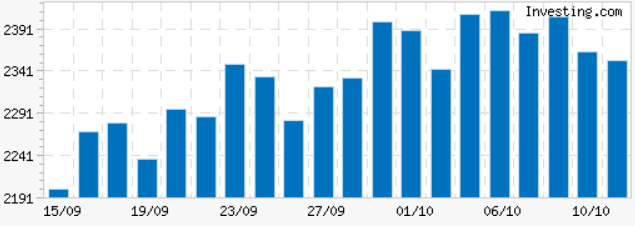

*Source Investing.com Calculator

The last two weeks have shown an increase in the volatility of the precious metal, which has consistently stayed above the level of 2,341 points. The uptrend seems to be losing momentum during the last week.

Stocks to Watch

Earnings: Below are the stocks to monitor for the rest of the week will announce their earnings.

| Wednesday, October 13, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | JPMorgan (JPM) | 3 | 29.86B | 497.95B | Before Market Open |

| US | BlackRock (BLK) | 9.6 | 4.82B | 127.8B | Before Market Open |

| US | Infosys ADR (INFY) | 0.1678 | 3.94B | 93.92B | Before Market Open |

| US | Wipro ADR (WIT) | 0.0699 | 2.6B | 47.23B | Before Market Open |

| US | Delta Air Lines (DAL) | 0.1614 | 8.41B | 27.54B | Before Market Open |

| UK | Just Eat Takeaway (JETJ) | - | - | 11.53B | -- |

| US | 888 Holdings (888) | - | - | 1.47B | -- |

| Thursday, October 14, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | Taiwan Semiconductor (TSM) | 1.04 | 14.84B | 531.47B | -- |

| US | Bank of America (BAC) | 0.7075 | 21.65B | 368.4B | Before Market Open |

| US | Wells Fargo&Co (WFC) | 0.9953 | 18.22B | 197.11B | Before Market Open |

| US | Morgan Stanley (MS) | 1.69 | 13.93B | 177.51B | Before Market Open |

| US | Citigroup (C) | 1.74 | 17.06B | 145.28B | |

| US | Domino’s Pizza (DOM) | - | - | 13.01B | -- |

| Friday, October 15, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | Honeywell (HON) | 2 | 8.67B | 148.64B | -- |

| US | Goldman Sachs (GS) | 10.11 | 11.72B | 124B | Before Market Open |

| US | Truist Financial Corp (TFC) | 1.09 | 5.52B | 80.4B | Before Market Open |

| UK | Schroders (SDR) | - | - | 8.97B | -- |

| UK | Hargreaves Lansdown (HRGV) | - | - | 6.92B | -- |