Market Update 18/10/2021

EUR/USD

Last Wednesday’s strong CPI report, which showed a headline inflation of 5.4% (Core at 4%), keeps adding pressure to the “transitory” narrative and practically confirming the taper announcement by the Federal Reserve in next month’s meeting. EURUSD closed last week trading around the 1.1600 level after having found a new support around the 1.1540 area (minimum since July 2020). If the pair overcame the “psychological” figure, the next target level would be around 1.1685, which has worked as a support level for the pair since October 2020 and was only broken at the end of last September.

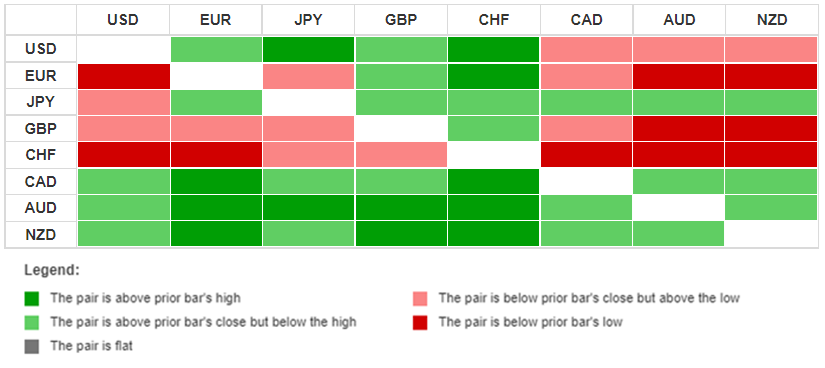

Currency Heatmap

The Currency Heatmap shows how the New Zealand Dollar keeps outperforming the rest of its major peers, with the Australian Dollar and the Canadian Dollar being the next in line. On the other side of the spectrum, we can find the Swiss Franc as the relatively weakest on the panel, followed with the Sterling which holds relatively stronger only against the Franc.

Gold

Gold finished last week roughly 0.6% up after last Friday’s selloff that pushed the price down over 1.5%. The price stopped around the USD/oz 1,767 level, which has been serving as the upper end of the price range within the precious metal had been trading for a month. If the price consolidated over this level, the next target price would be around the key level of USD/oz 1,800.

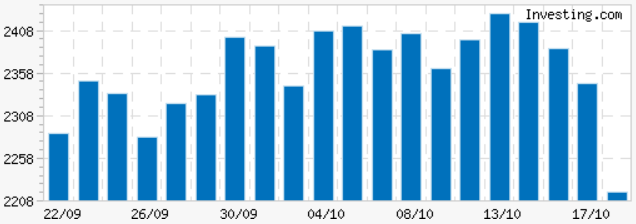

*Source Investing.com Calculator

After peaking above 2,408 points, Volatility is experiencing a significant reduction in comparison to last week, currently standing around 2,208 points.

Stocks to Watch

Earnings:Below are the stocks to monitor for the rest of the week will announce their earnings.

| Monday, October 18, 2021 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | Time |

| US | State Street | 1.92 | 2.96B | 35.49B | Before Market Open |

| US | Steel Dynamics | 4.62 | 4.95B | 12.96B | After Market Close |

| US | Zions | 1.36 | 707.41M | 9.9B | After Market Close |

| US | FB Financial | 0.8124 | 137.85M | 2.14B | After Market Close |

| Tuesday, October 19, 2021 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | Time |

| US | J&J | 2.36 | 23.66B | 431.38B | Before Market Open |

| US | Procter&Gamble | 1.59 | 19.79B | 340.38B | Before Market Open |

| US | Netflix | 2.57 | 7.48B | 282.82B | After Market Close |

| US | Philip Morris | 1.56 | 7.92B | 149.29B | Before Market Open |

| US | Intuitive Surgical | 1.17 | 1.39B | 120.05B | -- |

| US | Canadian National Railway | 1.41 | 3.51B | 87.89B | After Market Close |

| US | America Movil ADR | 6.43 | 245.52B | 58.91B | After Market Close |

| US | Bank of NY Mellon | 1.01 | 3.95B | 49.76B | Before Market Open |

| US | Travelers | 1.91 | 8.15B | 38.77B | Before Market Open |

| US | Fifth Third | 0.9112 | 1.99B | 30.34B | Before Market Open |

| US | Synchrony Financial | 1.51 | 2.52B | 29.83B | Before Market Open |

| US | Kansas City Southern | 2.09 | 729.46M | 27.07B | Before Market Open |

| US | Dover | 1.85 | 2B | 24.18B | Before Market Open |

| US | Halliburton | 0.2765 | 3.9B | 23.24B | Before Market Open |

| US | Signature Bank | 3.7 | 513.4M | 17.78B | Before Market Open |

| US | Omnicom | 1.37 | 3.46B | 16.4B | After Market Close |

| US | United Airlines Holdings | -1.51 | 7.56B | 14.96B | After Market Close |

| US | Synovus | 1.07 | 488.52M | 7.03B | Before Market Open |

| US | ManpowerGroup | 1.91 | 5.31B | 5.75B | Before Market Open |

| US | Brinker | 0.7413 | 874.6M | 2.22B | After Market Close |

| UK | Bellway | 167.00 | 1,457M | 365.92M | Before Market Open |

| Wednesday, October 20, 2021 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | Time |

| US | Tesla | 1.52 | 13.57B | 855.64B | After Market Close |

| US | ASML ADR | 4.61 | 6.19B | 325.68B | Before Market Open |

| US | Verizon | 1.36 | 33.32B | 216.74B | Before Market Open |

| US | Abbott Labs | 0.9442 | 9.55B | 211.57B | Before Market Open |

| US | NextEra Energy | 0.7258 | 5.38B | 160.92B | Before Market Open |

| US | IBM | 2.53 | 17.78B | 127.26B | -- |

| US | Anthem | 6.39 | 35.35B | 96B | Before Market Open |

| US | Lam Research | 8.23 | 4.32B | 80.37B | -- |

| US | CSX | 0.378 | 3.07B | 76.8B | After Market Close |

| US | Crown Castle | 0.7687 | 1.61B | 74.72B | After Market Close |

| US | Kinder Morgan | 0.2353 | 3.24B | 41.82B | -- |

| US | Biogen | 4.12 | 2.67B | 39.96B | Before Market Open |

| US | Discover | 3.49 | 2.89B | 39.28B | After Market Close |

| US | PPG Industries | 1.59 | 4.26B | 37.73B | After Market Close |

| US | Nasdaq Inc | 1.71 | 833.05M | 34.92B | Before Market Open |

| US | Equifax | 1.73 | 1.18B | 33.28B | After Market Close |

| US | Las Vegas Sands | -0.1795 | 1.23B | 30.79B | After Market Close |

| US | United Rentals | 6.82 | 2.58B | 25.59B | -- |

| US | Northern Trust | 1.67 | 1.61B | 25.3B | Before Market Open |

| US | Baker Hughes | 0.2138 | 5.33B | 22.26B | Before Market Open |

| US | Citizens Financial Group Inc | 1.15 | 1.64B | 20.92B | -- |

| US | M&T Bank | 3.5 | 1.48B | 19.51B | Before Market Open |

| US | MarketAxesss | 1.46 | 164.27M | 15.63B | Before Market Open |

| US | Comerica | 1.64 | 733.67M | 11.25B | -- |

| US | Globe Life | 1.9 | 1.27B | 9.92B | After Market Close |

| US | First Horizon National | 0.3517 | 745.18M | 9.35B | Before Market Open |

| US | SEI | 0.955 | 483.02M | 8.81B | After Market Close |

| US | Knight Transportation | 1.06 | 1.51B | 8.42B | Before Market Open |

| US | First Industrial RT | 0.2198 | 118.4M | 7.37B | After Market Close |

| US | Tenet Healthcare | 1.03 | 4.8B | 6.9B | After Market Close |

| US | Popular | 2.24 | 649.16M | 6.47B | Before Market Open |

| US | Landstar | 2.48 | 1.64B | 6.37B | After Market Close |

| US | Sterling Bancorp | 0.515 | 250.58M | 5.03B | After Market Close |

| US | MSC Industrial Direct | 1.27 | 838.86M | 4.78B | -- |

| US | Ufp Industries | 1.55 | 1.82B | 4.6B | -- |

| US | Umpquas | 0.4389 | 311.44M | 4.51B | After Market Close |

| US | TechnipFMC | 0.0158 | 1.7B | 1.77B | After Market Close |

| Thursday, October 21, 2021 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | Time |

| US | PayPal Holdings Inc | 1.07 | 6.24B | 319.26B | -- |

| US | Intel | 1.11 | 18.24B | 223.99B | After Market Close |

| US | Danaher | 2.14 | 7B | 220.22B | Before Market Open |

| US | AT&T | 0.7839 | 41.67B | 182.71B | Before Market Open |

| US | SAP ADR | 1.7 | 7.9B | 171.32B | -- |

| US | Union Pacific | 2.49 | 5.43B | 147.22B | Before Market Open |

| US | Snap | -0.0975 | 1.1B | 121.59B | After Market Close |

| UK | Unilever | -- | 13.28B | 97.35B | Before Market Open |

| US | Marsh McLennan | 0.9974 | 4.42B | 83.42B | Before Market Open |

| US | ABB ADR | 0.374 | 7.38B | 69.31B | Before Market Open |

| US | Freeport-McMoran | 0.8161 | 6.21B | 57.03B | -- |

| US | Chipotle Mexican Grill | 6.3 | 1.94B | 51.73B | After Market Close |

| US | SVB | 5.53 | 1.32B | 41.06B | After Market Close |

| UK | Barclays | 0.0671 | 5.36B | 33.55B | Before Market Open |

| US | Valero Energy | 0.8593 | 24.85B | 32.77B | -- |

| US | Nucor | 6.93 | 10.15B | 30.34B | Before Market Open |

| US | Southwest Airlines | -0.2703 | 4.58B | 29.22B | -- |

| US | Tractor Supply | 1.65 | 2.85B | 23.27B | Before Market Open |

| US | KeyCorp | 0.5649 | 1.75B | 22.19B | Before Market Open |

| US | Genuine Parts | 1.64 | 4.68B | 18.3B | -- |

| US | Celanese | 4.73 | 2.13B | 18.29B | After Market Close |

| US | NVR | 91.55 | 2.36B | 18.02B | -- |

| US | Quest Diagnostics | 2.71 | 2.43B | 17.8B | Before Market Open |

| US | IPG | 0.4878 | 2.17B | 15.06B | Before Market Open |

| US | WR Berkley | 0.9517 | 2.03B | 13.75B | After Market Close |

| US | Whirlpool | 6.11 | 5.78B | 12.89B | After Market Close |

| US | American Airlines | -1.09 | 8.83B | 12.64B | -- |

| US | Snap-On | 3.37 | 1.02B | 12.16B | Before Market Open |

| US | Allegion PLC | 1.3 | 724.87M | 12.08B | Before Market Open |

| US | Robert Half | 1.4 | 1.65B | 12.04B | After Market Close |

| US | East West Bancorp | 1.51 | 459.13M | 11.96B | Before Market Open |

| US | Carlisle | 2.75 | 1.26B | 11.2B | After Market Close |

| US | AutoNation | 4.16 | 6.39B | 8.27B | -- |

| US | Olin | 1.98 | 2.36B | 8.13B | After Market Close |

| US | First American | 1.82 | 2.03B | 8.03B | Before Market Open |

| US | People’s United | 0.335 | 479.73M | 7.51B | After Market Close |

| US | Alaska Air | 1.09 | 1.89B | 7.13B | -- |

| US | Chart Industries | 0.8481 | 347.33M | 6.63B | -- |

| US | Sonoco Products | 0.8973 | 1.37B | 5.99B | Before Market Open |

| US | Bank Ozk | 0.9666 | 266.46M | 5.79B | After Market Close |

| US | Alliance Data Systems | 3.48 | 1.09B | 5.02B | -- |

| US | Pacific Premier | 0.8233 | 188.88M | 3.96B | Before Market Open |

| US | Trinity Industries | 0.176 | 453.98M | 2.85B | Before Market Open |

| US | Score Media and Gaming | -0.1924 | 7.26M | 2.02B | -- |

| Friday, October 22, 2021 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | Time |

| US | Honeywell | 1.99 | 8.65B | 153.12B | Before Market Open |

| US | American Express | 1.77 | 10.54B | 140.86B | Before Market Open |

| US | HCA | 3.96 | 14.52B | 79.61B | Before Market Open |

| US | Roper Technologies | 3.83 | 1.61B | 49.98B | Before Market Open |

| US | Schlumberger | 0.3563 | 5.94B | 48.3B | Before Market Open |

| US | VF | 1.15 | 3.5B | 28.86B | Before Market Open |

| US | Ventas | 0.0488 | 914.66M | 21.99B | -- |

| US | Regions Financial | 0.5259 | 1.56B | 21.54B | Before Market Open |

| US | Royal Caribbean Cruises | -4.13 | 612.15M | 21.51B | -- |

| US | Seagate | 2.21 | 3.11B | 18.33B | Before Market Open |

| US | InterContinental ADR | 0.2033 | -- | 12.61B | Before Market Open |

| US | Cleveland-Cliffs | 2.21 | 5.69B | 10.5B | Before Market Open |

| UK | InterContinental | 0.2033 | -- | 9.14B | Before Market Open |

| US | Gentex | 0.4013 | 445.43M | 8.72B | Before Market Open |

| US | Autoliv | 0.8197 | 1.89B | 8.26B | Before Market Open |

| US | Boston Beer | 4.26 | 531.88M | 6.22B | After Market Close |

| US | Goodyear Tire & Rubber Co | 0.2353 | 4.86B | 5.36B | -- |

| US | Altra | 0.824 | 473.4M | 3.63B | Before Market Open |

| US | Salisbury | 1.5 | 11.8M | 148.13M | -- |

Dividends:The following stocks will be paying dividends over this week.

| Tuesday, October 19, 2021 | ||||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Type | Yield |

| US | Lowe’s | 44488 | 0.8 | USD | Quarterly | 1.45% |

| US | Reaves Utility | 44488 | 0.19 | USD | Monthly | 6.83% |

| Wednesday, October 20, 2021 | ||||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Type | Yield |

| US | Colgate-Palmolive | 44489 | 0.45 | USD | Quarterly | 2.39% |

| US | LTC Properties | 44489 | 0.19 | USD | Monthly | 6.54% |

| Thursday, October 21, 2021 | ||||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Type | Yield |

| US | Aberdeen Income Credit Strategies Fund | 44490 | 0.1 | USD | Monthly | 10.67% |

| US | APA Corp | 44490 | 0.0625 | USD | Quarterly | 0.93% |

| US | Cervecerias ADR | 44490 | 0.52295 | USD | Biannually | 6.39% |

| US | Cracker Barrel Old | 44490 | 1.3 | USD | Quarterly | 3.82% |

| US | CVS Health Corp | 44490 | 0.5 | USD | Quarterly | 2.37% |

| US | ETV New York MBF | 44490 | 0.0378 | USD | Monthly | 3.65% |

| US | Gladstone Land | 44490 | 0.1356 | USD | Quarterly | 2.33% |

| US | Owens Corning | 44490 | 0.26 | USD | Quarterly | 1.13% |

| US | Patterson | 44490 | 0.26 | USD | Quarterly | 3.27% |

| US | Pentair | 44490 | 0.2 | USD | Quarterly | 1.10% |

| US | PerkinElmer | 44490 | 0.07 | USD | Quarterly | 0.16% |

| US | Procter&Gamble | 44490 | 0.8698 | USD | Quarterly | 2.44% |

| US | Putnam Municipal Opportunit Trust | 44490 | 0.0531 | USD | Monthly | 4.63% |

| UK | PZ Cussons | 44490 | 6.09 | GBP | Trailing Twelve Months | 2.77% |

| UK | Smiths Group | 44490 | 37.7 | GBP | Trailing Twelve Months | 2.69% |

| US | Thor Industries | 44490 | 0.43 | USD | Quarterly | 1.57% |

| US | Williams-Sonoma | 44490 | 0.71 | USD | Quarterly | 1.53% |