Market Update 26/07/2021

EUR/USD

The EURUSD pair over the last trading week has been settled within the 1.1825 – 1.1752 range, after breaking the 1.1795 resistance level. This week is packed with key economic data that should motivate the pair to finally break out of this range, with the US Fed interest rate decision and Q2 GDP data, the EU CPI figures and the ECB Publishes account of the Monetary policy meeting. The strong area of support still stands around the 1.1700 level, with the first resistance level that needs to be broken to gain some upwards momentum is at 1.1850, there should be a much clearer picture on the direction of this pair come this Friday.

Key Economic Data

Below is the high impact news for this week, do not allow yourself to be caught out by high impact forex news.

| Date | Event | Time (GMT+3) | Forecast | Previous |

| Monday, July 26, 2021 | ||||

| EUR | German Ifo Business Climate Index (Jul) | 11:00 | 102.1 | 101.8 |

| USD | New Home Sales (Jun) | 17:00 | 800K | 769K |

| Tuesday, July 27, 2021 | ||||

| USD | Core Durable Goods Orders (MoM) (Jun) | 15:30 | 0.80% | 0.30% |

| USD | CB Consumer Confidence (Jul) | 17:00 | 124.1 | 127.3 |

| Wednesday, July 28, 2021 | ||||

| AUD | CPI (QoQ) (Q2) | 04:30 | 0.70% | 0.60% |

| CAD | Core CPI (MoM) (Jun) | 15:30 | 0.40% | 0.40% |

| USD | Crude Oil Inventories | 17:30 | - | 2.108M |

| USD | FOMC Statement | 21:00 | - | - |

| USD | Fed Interest Rate Decision | 21:00 | 0.25% | 0.25% |

| USD | FOMC Press Conference | 21:30 | - | - |

| Thursday, July 29, 2021 | ||||

| EUR | German Unemployment Change (Jul) | 10:55 | -25K | -38K |

| EUR | ECB Publishes Account of Monetary Policy Meeting | 14:30 | - | - |

| USD | GDP (QoQ) (Q2) | 15:30 | 8.60% | 6.40% |

| USD | Initial Jobless Claims | 15:30 | - | 419K |

| USD | Pending Home Sales (MoM) (Jun) | 17:00 | 0.50% | 8.00% |

| Friday, July 30, 2021 | ||||

| EUR | German GDP (QoQ) (Q2) | 09:00 | 2.00% | -1.80% |

| EUR | CPI (YoY) (Jul) | 12:00 | 2.00% | 1.90% |

| CAD | GDP (MoM) (May) | 15:30 | -0.30% | -0.30% |

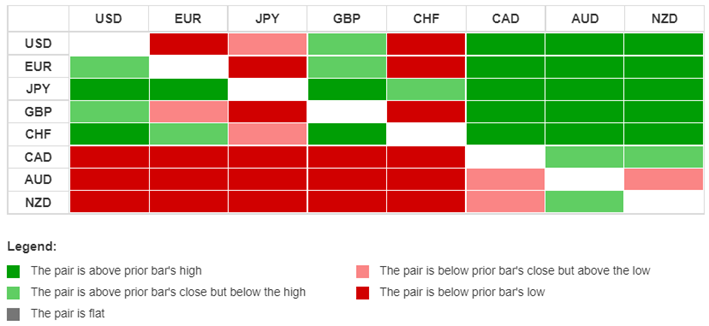

Daily Currency Heatmap

On the Daily currency Heatmap we can see that the Canadian Dollar weakness continues from last week and is joined by the Australian Dollar and the New Zealand Dollar. The Japanese Yen is showing the most strength against the other pairs, in the recent days.

Gold

Gold is still currently trading around the $1808 price level, since our last look at gold it tested the $1824 resistance once again, before retreating to the $1795 area of short-term support. The $1800 level still serves as a psychological support level. Over the past week the precious metal has been ranging between the $1824 & 1794 Price levels, this may change this week with a lot of key US economical data to be released. The key level of resistance is the $1824 level a break of this level may see gold rise to the $1850 - $1862 range. Our strong support is still in the $1750-$1747 area.

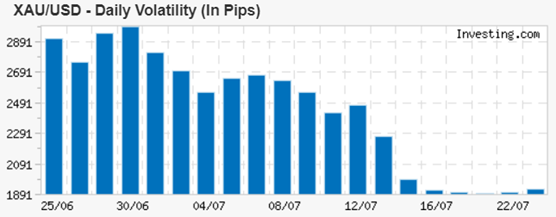

*Source Investing.com Calculator

In the above table we can see the continuation of the decline in the gold volatility against the US dollar, although in this week’s economic data on Wednesday there is the FED’s Interest Rate Decision. This may cause the volatility of the precious metal to increase especially during the build up to the announcement, even if the rate does not change the rate from the previous 0.25%.

Stocks to Watch

Earnings: Below are the stocks to monitor for the rest of the week will announce their earnings.

| Monday, July 26, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | Tesla (TSLA) | 0.9364 | 11.53B | 619.79B | After Market Close |

| US | Lockheed Martin (LMT) | 6.53 | 16.94B | 105.83B | Before Market Open |

| UK | Philips (0LNG) | 0.4068 | 4.2B | 35.31B | Before Market Open |

| UK | Michelin (0OFM) | - | 5.41B | 24.22B | After Market Close |

| UK | Ryanair (RYA) | -0.2437 | 392.62M | 18.42B | - |

| US | Hasbro (HAS) | 0.481 | 1.16B | 12.71B | - |

| Tuesday, July 27, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | Apple (AAPL) | 1.01 | 73.26B | 2.48T | Before Market Open |

| US | Microsoft (MSFT) | 1.91 | 44.06B | 2.18T | Before Market Open |

| US | Alphabet A (GOOGL) | 19.24 | 56.19B | 1.78T | Before Market Open |

| US | Visa A (V) | 1.34 | 5.85B | 493.03B | Before Market Open |

| US | United Parcel Service (UPS) | 2.79 | 23.19B | 184.24B | After Market Close |

| US | Starbucks (SBUX) | 0.7744 | 7.26B | 148.43B | Before Market Open |

| US | Raytheon Technologies (RTX) | 0.9291 | 15.83B | 130.01B | After Market Close |

| US | 3M (MMM) | 2.29 | 8.53B | 116.22B | - |

| US | AMD (AMD) | 0.5414 | 3.62B | 111.96B | After Market Close |

| Wednesday, July 28, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | Facebook (FB) | 3.04 | 27.85B | 1.05T | After Market Close |

| US | PayPal Holdings Inc (PYPL) | 1.12 | 6.27B | 362.44B | After Market Close |

| US | Shopify Inc (SHOP) | 0.9711 | 1.05B | 256.43B | Before Market Open |

| US | Pfizer (PFE) | 0.9672 | 18.62B | 233.31B | - |

| US | McDonald’s (MCD) | 2.11 | 5.58B | 181.29B | Before Market Open |

| US | Qualcomm (QCOM) | 1.68 | 7.53B | 163.42B | - |

| US | Bristol-Myers Squibb (BMY) | 1.89 | 11.29B | 152.59B | Before Market Open |

| US | Boeing (BA) | -0.8103 | 16.72B | 129.55B | - |

| UK | Rio Tinto PLC (RIO) | 7.45 | 33,248M | 97.96B | Before Market Open |

| Thursday, July 29, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| UK | Mitsubishi Electric (MELM) | 19.25 | 993.39B | 3.22T | - |

| UK | Panasonic (0QYR) | 16.69 | 1,641.79B | 3.08T | - |

| US | Amazon.com (AMZN) | 12.24 | 115.33B | 1.84T | After Market Close |

| US | Mastercard (MA) | 1.74 | 4.36B | 389.74B | - |

| UK | L'Oreal (0NZM) | -- | 7.32B | 215.10B | - |

| UK | Merck&Co (MRK) | 1.4 | 11.09B | 196.34B | - |

| US | T-Mobile US (TMUS) | 0.5091 | 19.36B | 179.55B | After Market Close |

| UK | AstraZeneca (AZN) | 0.9029 | 7.4B | 129.72B | Before Market Open |

| US | Gilead (GILD) | 1.73 | 6.09B | 86.56B | After Market Close |

| Friday, July 30, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | Berkshire Hathaway B (BRKb) | 2.47 | 64.65B | 639.73B | - |

| US | Procter&Gamble (PG) | 1.09 | 18.37B | 342.24B | - |

| US | Exxon Mobil (XOM) | 1 | 63.25B | 241.48B | Before Market Open |

| US | AbbVie (ABBV) | 3.08 | 13.63B | 208.75B | Before Market Open |

| US | Chevron (CVX) | 1.58 | 36.09B | 190.61B | - |

| US | Linde PLC (LIN) | 2.55 | 7.38B | 155.48B | Before Market Open |

| US | Caterpillar (CAT) | 2.41 | 12.51B | 114.78B | Before Market Open |

| US | Aon (AON) | 1.85 | 2.67B | 52.45B | Before Market Open |

Dividends: The following stocks will be paying dividends over this week.

| Thursday, July 29, 2021 | Stock | Ex Div Date | Dividend | Type | Yield |

| US | CIT (CIT) | Jul 29, 2021 | 0.35 | Quarterly | 2.96% |

| US | Costco (COST) | Jul 29, 2021 | 0.79 | Quarterly | 0.76% |

| US | Morgan Stanley (MS) | Jul 29, 2021 | 0.7 | Quarterly | 2.93% |

| US | Pfizer (PFE) | Jul 29, 2021 | 0.39 | Quarterly | 3.76% |

| UK | Royal Mail (RMG) | Jul 29, 2021 | 10 | 12 months trailing | 1.88% |

| UK | SSE (SSE) | Jul 29, 2021 | 81 | 12 months trailing | 5.41% |

| Friday, July 30, 2021 | Stock | Ex Div Date | Dividend | Type | Yield |

| US | Aon (AON) | Jul 30, 2021 | 0.51 | Quarterly | 0.88% |

| US | Citigroup (C) | Jul 30, 2021 | 0.51 | Quarterly | 3.05% |

| US | Hasbro (HAS) | Jul 30, 2021 | 0.68 | Quarterly | 2.92% |

| US | Levi Strauss A (LEVI) | Jul 30, 2021 | 0.08 | Quarterly | 1.19% |

Market Holidays

Holidays: The following countries have national holidays this week.

| Date | Holiday | Time | Affected Markets |

| Monday, July 26, 2021 | |||

| Thailand | Asarnha Bucha Day | All Day | Stock Exchange of Thailand |

| Wednesday, July 21, 2021 | |||

| Thailand | H.M. The King's Birthday | All Day | Stock Exchange of Thailand |