Market Update 07/07/2021

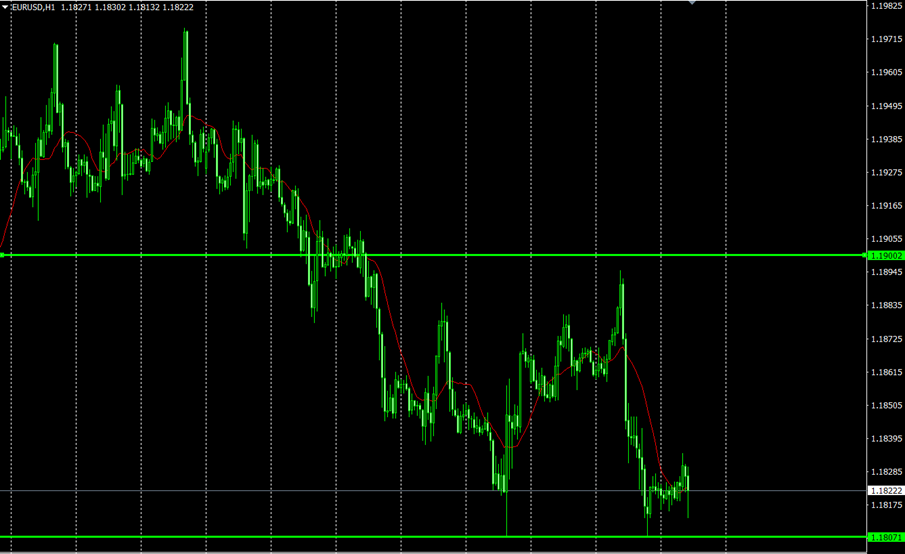

EUR/USD

The EURUSD pair has recently tested the 1.1900 handle, after failing to break the resistance at this level we may see the pair moving towards testing the support at the 1.1805-1.1795 price level. The focus for the greenback this week will be on the FOMC minutes meeting later today, and the pair may see some volatility with Thursday’s ECB monetary policy statement.

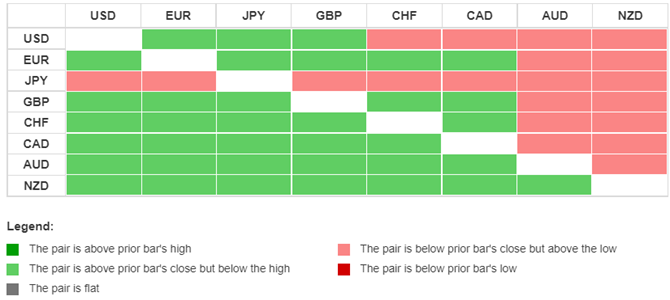

Daily Currency Heatmap

On the Daily currency Heatmap we can see that the New Zealand Dollar is currently showing the most weakness against the rest of the major currency pairs. The Japanese Yen is showing the most strength against the other pairs, after some positive economic news announcements.

Gold

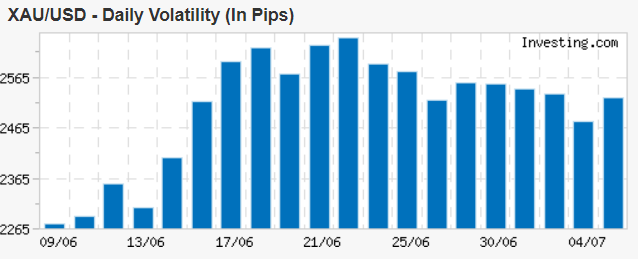

Gold has found some support at the $1750 price level, slowing down the strong downward momentum experienced in the month of June. The precious metal increased in value testing and finally breaking the $1800 resistance yesterday. The Pivot Point for the current week is at $1801 this may serve as a short-term psychological support; A break down through this psychological support may see gold moving down to retest the $1757 - $1750 range. The key level of resistance is the $1824 level a break of this level may see gold rise to the $1850 - $1862 range.

*Source Investing.com Calculator

In the above table we can see the gold volatility against the US dollar, this week has seen a reduction in the level of volatility in comparison with the last 10 days of June.

Stocks to Watch

Earnings: Below are the stocks to monitor for the rest of the Week 27 that will announce their earnings.

| Thursday, July 8, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | Accolade (ACCD) | -0.3417 | 55.76M | 3.18B | After Market Close |

| UK | Superdry (SDRY) | -- | -- | 353.20M | Not Stated |

Dividends: The following stocks will be paying dividends over the next 2 days.

| Thursday, July 8, 2021 | Stock | Ex Div Date | Dividend | Type | Yield |

| US | AT&T (T) | Jul 08, 2021 | 0.52 | Quarterly | 7.12% |

| UK | British American Tobacco (BATS) | Jul 08, 2021 | 213 | Trailing 12 Month | 7.62% |

| UK | Halma (HLMA) | Jul 08, 2021 | 17.65 | Trailing 12 Month | 0.64% |

| US | Marvell (MRVL) | Jul 08, 2021 | 0.06 | Quarterly | 0.42% |

| US | Mastercard (MA) | Jul 08, 2021 | 0.44 | Quarterly | 0.47% |

| US | NetApp (NTAP) | Jul 08, 2021 | 0.5 | Quarterly | 2.41% |

| US | Verizon (VZ) | Jul 08, 2021 | 0.6275 | Quarterly | 4.45% |

| Friday, July 9, 2021 | Stock | Ex Div Date | Dividend | Type | Yield |

| US | Intuit (INTU) | Jul 09, 2021 | 0.59 | Quarterly | 0.47% |

| US | Schnitzer (SCHN) | Jul 09, 2021 | 0.1875 | Quarterly | 1.53% |