Market Update 08/03/2022

EUR/USD

Finally, some respite for the European currency. In fact, the so far better mood in the risk complex lends support to EUR/USD, pushing it to levels beyond the 1.0900 figure on turnaround Tuesday.

Geopolitical Pressure

EUR/USD prints decent gains and manages to leave behind six consecutive sessions of losses, as market participants appear to favor risk early in the European morning.

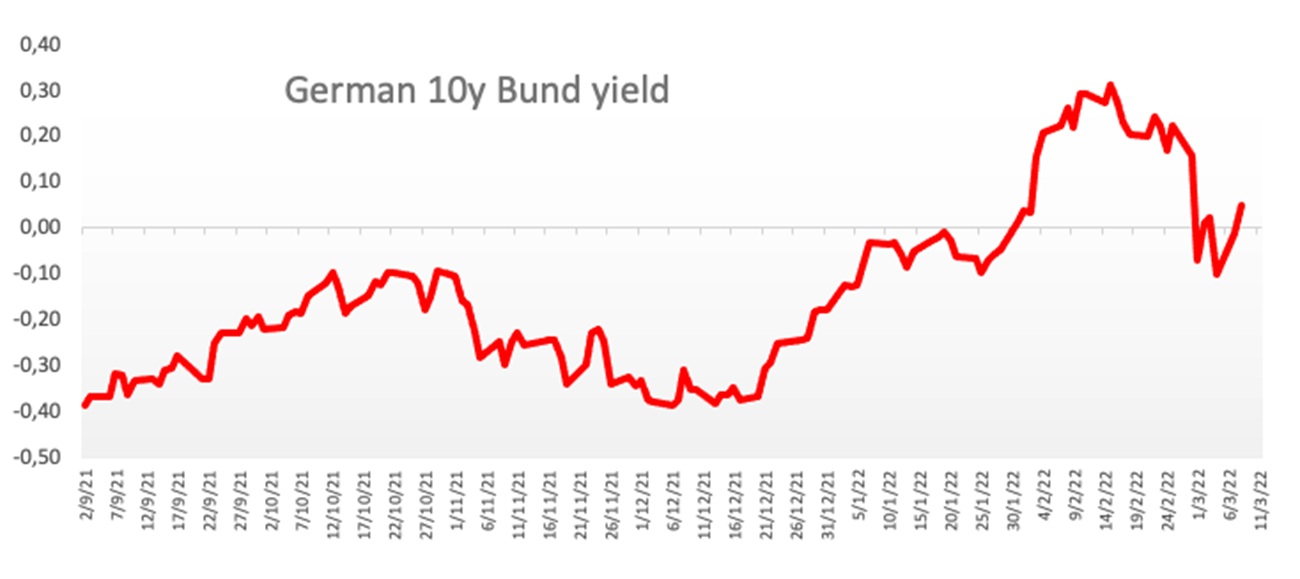

The better tone in the risk complex re-emerged in response to news citing the EU could be planning a massive joint bond sale to fund energy and defense spending against the backdrop of the current instability sparked in the wake of the Russian invasion of Ukraine. The daily recovery in the pair is also underpinned by the rebound in German 10y Bund yields back to positive territory around 0.05%.

What to look for around EUR

EUR/USD collapsed to levels last seen in May 2020 near the 1.0800 yardstick on Monday, just to regain some composure afterwards. The European currency is expected to remain under heavy pressure for as long as the Russia-Ukraine conflict lasts along with the persistent risk aversion, altogether bolstering the “flight-to-safety” environment. In the longer run, occasional strength in the pair should remain underpinned by speculation of a potential interest rate hike by the ECB probably sooner than many anticipate, higher German yields, persevering elevated inflation, the decent pace of the economic recovery and auspicious results from key fundamentals in the region.

Key events in the euro area this week: EMU Flash Q4 GDP (Tuesday) – ECB interest rate decision (Thursday) – Germany Final CPI.

Eminent issues: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

Goldman Sachs raises gold forecast on strongest demand impulse since the Global Financial Crisis

Targets raised by Goldman Sachs:

- 3-month horizon to USD2,300, from $1950 previously

- 6-month horizon to USD2,500, from $2050 previously

- 12-month horizon to USD2,500, from $2150 previously

GS citing an increase in demand from consumers, investors, central banks. Due to the rising geopolitical uncertainty.

Energy War in Ukraine

Russia says it may cut gas supplies if oil ban goes ahead Russia has said it may close its main gas pipeline to Germany if the West goes ahead with a ban on Russian oil. Deputy Prime Minister Alexander Novak said a "rejection of Russian oil would lead to catastrophic consequences for the global market", causing prices to more than double to $300 a barrel.

The US has been exploring a potential ban with allies as a way of punishing Russia for its invasion of Ukraine. But Germany and the Netherlands rejected the plan on Monday.

The EU gets about 40% of its gas and 30% of its oil from Russia, and has no easy substitutes if supplies are disrupted. While the UK would not be directly impacted by supply disruption, as it imports less than 5% of its gas from Russia, it would be affected by prices rising in the global markets as demand in Europe increases.

Iain Conn, the former boss of British Gas owner Centrica, said natural gas was "less freely" traded compared to oil, and it would be "much more difficult" to replace Russian gas if supplies are affected as it is transported through fixed pipelines from country to country.

Sources* Goldman, BBC News, FXStreet.