Market Update 13/01/2022

Wall Street rises as inflation data backs Fed bets.

U.S. stock indexes rose on Wednesday after data showed that while U.S. inflation was at its highest in decades, it largely met economists' expectations, cooling some fears that the Federal Reserve would have to pull back support even more forcibly than already expected.

Ten (10) out of the 11 major S&P sectors finished higher after the news with the S&P500 and the Nasdaq outperforming the Dow as growth stocks outperformed value.

Data from the Labor Department showed the consumer price index (CPI) increased 0.5% last month after rising 0.8% in November, while in the 12 months through December, the CPI surged 7.0% to its highest year-on-year rise in nearly four decades.

Biden’s Statement?

U.S. President Joe Biden admitted on Wednesday that his administration still had "more work to do with price increases still too high" even as he stated that there was progress made in slowing the rate of price rises. His statement was released by the White House after U.S. consumer prices increased solidly in December, culminating in the largest annual rise in inflation in nearly four decades. "We are making progress in slowing the rate of price increases. At the same time, this report underscores that we still have more work to do, with price increases still too high and squeezing family budgets", Biden said.

Oil Rally Continues

The New Year rally in oil showed no signs of slowing on Wednesday as those long the market added another 2% to crude prices after the previous day’s 4% climb.

U.S. government data, meanwhile, clearly showed a slump in demand for gasoline as the onset of winter reduced driving and the need to fill up auto tanks as much as during the recent holiday stretch. A surge in the Omicron variant of Covid also delayed plans by employers to bring workers back into offices, reducing commuting and other travel that required fuel.

Brent Oil

Crude Oil

S&P 500

The S&P500 closed higher Wednesday, as data showing inflation hitting the fastest pace in decades, which was largely expected, failed to spook investors.

S&P500 rose 0.3%, the Dow Jones Industrial Average gained 0.1%, or 39 points, the Nasdaq added 0.2%. The consumer price index rose 0.6% in December, just above expectations for a 0.5% increase, taking the year-on-year consumer prices through December to 7%, in-line with expectations and the fastest rate since 1982. A deeper look into the report, however, showed sticker areas of price pressures, particularly from the services sector, rose by less than expected, stoking early hopes that inflation may cool in the months ahead.

US500

US100

Gold Down

Gold was down on Thursday morning in Asia but remained near the one-week high hit in the previous session. The U.S. dollar and Treasury yields retreated after U.S. inflation data highlighted the need for a quicker interest rate hike.

XAUUSD

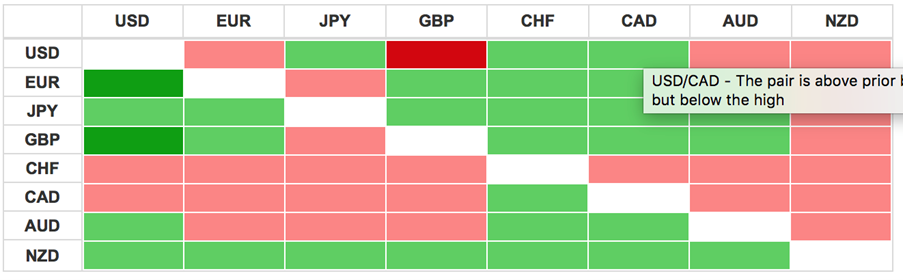

Daily Currencies Heat Map

The dollar fell to a two-month low against a basket of currencies on Wednesday after data, which showed an expected surge in U.S. consumer prices in December, fell short of offering any new impetus for the Federal Reserve's policy normalization efforts.

EURUSD

Earnings

| Monday, January 10, 2022 | ||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. |

| UK | Whitbread | -- | -- | 6.39B |

| US | Commercial Metals | 1.21 | 2.05B | 4.33B |

| US | Tilray | -- | -- | 3.05B |

| UK | Go-Ahead | -- | -- | 286.47M |

| Tuesday, January 11, 2022 | ||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. |

| UK | Games Workshop | -- | 95.00M | 3.24B |

| US | Tilray | -0.0833 | 171.79M | 3.05B |

| Wednesday, January 12, 2022 | ||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. |

| US | Shaw B | 0.37 | 1.39B | 15.03B |

| US | Jefferies Financial | 1.31 | 1.88B | 9.92B |

| UK | J Sainsbury | -- | -- | 6.43B |

| US | KB Home | 1.77 | 1.71B | 3.48B |

| UK | Big Yellow | -- | -- | 2.96B |

| Thursday, January 13, 2022 | ||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. |

| US | Taiwan Semiconductor | 1.12 | 15.65B | 602.57B |

| US | Delta Air Lines | 0.114 | 8.85B | 26.47B |

| US | Tesco | -- | -- | 22.14B |

| UK | Marks & Spencer | -- | 3.05B | 5.09B |

| FR | Score Media and Gaming | -0.0625 | 7.6M | 1.53B |

| Friday, January 14, 2022 | ||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. |

| US | JPMorgan | 3 | 29.87B | 494.00B |

| US | Wells Fargo&Co | 1.1 | 18.65B | 218.38B |

| US | BlackRock | 10.06 | 5.11B | 135.55B |

| US | Citigroup | 1.57 | 17.01B | 130.53B |

| US | First Republic Bank | 1.91 | 1.35B | 36.59B |

Dividends

| Monday, January 10, 2022 | |||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Yield |

| US | MSC Industrial Direct | Jan 10, 2022 | 0.75 | USD | 0.04 |

| Tuesday, January 11, 2022 | |||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Yield |

| US | InterDigital | Jan 11, 2022 | 0.35 | USD | 0.02 |

| Wednesday, January 12, 2022 | |||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Yield |

| US | Accenture | Jan 12, 2022 | 0.97 | USD | 0.01 |

| UK | PIMCO California Municipalome III | Jan 12, 2022 | 0.04 | GBP | 0.04 |

| Thursday, January 13, 2022 | |||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Yield |

| US | Abbott Labs | Jan 13, 2022 | 0.47 | USD | 0.01 |

| US | AbbVie | Jan 13, 2022 | 1.41 | USD | 0.04 |

| US | American Financial | Jan 13, 2022 | 0.56 | USD | 0.02 |

| FR | Arcosa | Jan 13, 2022 | 0.05 | GBP | 0.00 |

| UK | Ashtead Group | Jan 13, 2022 | 0.13 | USD | - |

| US | Bank Ozk | Jan 13, 2022 | 0.30 | USD | 0.02 |

| ES | BlackRock Health Sciences Trust | Jan 13, 2022 | 0.21 | USD | 0.05 |

| UK | BlackRock Long Term Muni Advantage | Jan 13, 2022 | 0.05 | GBP | 0.05 |

| DE | BNY Mellon Strategic Municipals | Jan 13, 2022 | 0.03 | USD | 0.04 |

| US | Cracker Barrel Old | Jan 13, 2022 | 1.30 | USD | 0.04 |

| US | EOG Resources | Jan 13, 2022 | 0.75 | USD | 0.03 |

| US | Foot Locker | Jan 13, 2022 | 0.30 | USD | 0.03 |

| US | Freeport-McMoran | Jan 13, 2022 | 0.08 | USD | 0.01 |

| US | Freeport-McMoran | Jan 13, 2022 | 0.08 | USD | 0.01 |

| US | General Dynamics | Jan 13, 2022 | 1.19 | USD | 0.02 |

| US | IDEX | Jan 13, 2022 | 0.54 | USD | 0.01 |

| US | Mid-America Apartment | Jan 13, 2022 | 1.09 | USD | 0.02 |

| UK | Next | Jan 13, 2022 | 160.00 | GBP | 0.03 |

| US | RPM | Jan 13, 2022 | 0.40 | USD | 0.02 |

| UK | Sage | Jan 13, 2022 | 11.63 | GBP | 0.02 |

| UK | Shaftesbury | Jan 13, 2022 | 1.25 | GBP | 0.01 |

| UK | Shaftesbury | Jan 13, 2022 | 2.75 | GBP | 0.01 |

| US | Shaw B | Jan 13, 2022 | 0.10 | USD | 0.03 |

| UK | SSE | Jan 13, 2022 | 25.50 | GBP | 0.05 |

| US | Trinity Industries | Jan 13, 2022 | 0.23 | USD | 0.03 |

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Yield |

| US | Hormel Foods | Jan 14, 2022 | 0.26 | USD | 0.02 |

| US | PNC Financial | Jan 14, 2022 | 1.25 | USD | 0.02 |

| SE | Sandstorm Gold Ltd N | Jan 14, 2022 | 0.02 | USD | 0.01 |