Market Update 21/01/2022

EUR/USD

The EUR/USD pair quickly reversed an Asian session dip to a near two-week low and shot to a fresh daily high, around the 1.1335 region in the last hour. The pair attracted some dip-buying near the 1.1300 mark on Friday and has now reversed a major part of the overnight losses. The EUR/USD pair is currently trading at the 1.1314 price.

GBP/USD

GBP/USD stays on the back foot in the early European session and continues to trade below 1.3600. The data from the UK showed on Friday that Retail Sales in December contracted by 3.7% monthly, worse than the market consensus for a decline of 0.6%.

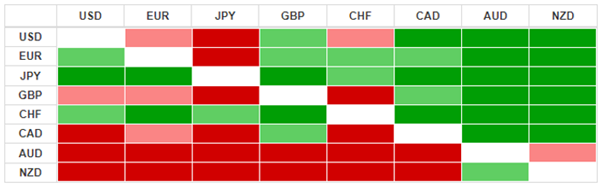

Currency Heatmap

*Source Investing.com Calculator

As we can see the Japanese Yen is the strongest currency against all majors. The Australian Dollar and the New Zealand Dollar are showing the most weakness of the majors.

Gold

Gold was down on Friday morning in Asia. However, the yellow metal was on course for a second consecutive weekly gain as investors brace for the U.S. Federal Reserve’s policy decision.

Gold futures inched down 0.07% to $1,841.30 by 11:19 PM ET (4:19 AM GMT), while benchmark U.S. 10-year Treasury yields dropped on Thursday.

Gold has gained about 1.2% so far this week and is set for its second weekly gain in three in January. Although it has had a positive start to 2022, it could be a difficult year for gold.

Investors now await the Fed’s next policy decision, due to be handed down on Jan. 25.

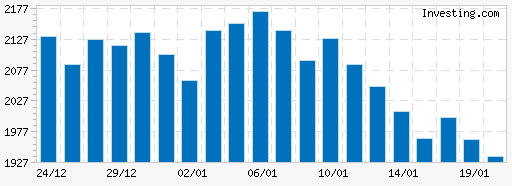

Gold Volatility Chart:

*Source Investing.com Calculator

As per the information published on investing.com shown in above we can see the steady decline in the volatility of the precious metal. This will most likely increase as we get closer to the FED interest rate decision next month.

OIL

Oil prices fell on Friday, after rising to seven-year highs this week, as investors took profits after a build in U.S. crude and fuel inventories, though overall sentiment remained solid due to concerns over tight supply and geopolitical risks.

Brent crude futures dropped $1.52, or 1.7%, to $86.86 a barrel by 0606 GMT. The contract earlier fell by as much as 3%, the most since Dec. 20. The global benchmark touched $89.50 a barrel on Thursday, its highest since October 2014.

U.S. West Texas Intermediate (WTI) crude futures slid $1.66, or 1.9%, to $83.89 a barrel. The contract earlier fell as much as 3.2%, also the most since Dec. 20, after rising to its highest since October 2014 on Wednesday.

The recent rally in crude prices appeared to run out of steam on Thursday when Brent and WTI ended the trading session with slim losses, but both benchmarks have gained more than 10% so far this year.

"An unexpected increase in U.S. crude stockpiles prompted investors to take profits," said Tatsufumi Okoshi, senior economist at Nomura Securities, adding the recent rally has been overdone.

WTI OIL

Brent OIL

Earnings

| Monday, January 17, 2021 | ||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. |

| US | Score Media and Gaming | -0.0625 | 7.6M | 1.53B |

| US | Bank of America | 0.7652 | 22.18B | 392.10B |

| US | Goldman Sachs | 11.73 | 12B | 127.07B |

| US | PNC Financial | 3.26 | 5.14B | 93.91B |

| US | Truist Financial Corp | 1.13 | 5.59B | 89.99B |

| US | Bank of NY Mellon | 1.01 | 3.97B | 52.52B |

| US | Signature Bank | 3.97 | 549.44M | 21.89B |

| US | JB Hunt | 2.01 | 3.28B | 21.22B |

| US | New Oriental Education&Tech | -0.1174 | 358.24M | 3.07B |

| US | FB Financial | 0.7984 | 138.5M | 2.24B |

| Thusday, January 18, 2021 | ||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. |

| US | UnitedHealth | 4.31 | 72.78B | 441.44B |

| US | Procter&Gamble | 1.66 | 20.34B | 386.73B |

| UK | ASML ADR | 4.27 | 5.88B | 302.18B |

| US | Morgan Stanley | 1.94 | 14.56B | 177.43B |

| US | Prologis | 0.7055 | 1.05B | 112.92B |

| US | U.S. Bancorp | 1.1 | 5.74B | 93.79B |

| US | Kinder Morgan | 0.2559 | 3.58B | 40.56B |

| US | State Street | 1.88 | 3.01B | 37.94B |

| US | Discover | 3.64 | 2.99B | 37.38B |

| US | Fastenal | 0.3766 | 1.49B | 34.05B |

| US | Citizens Financial Group Inc | 1.11 | 1.67B | 24.02B |

| US | United Airlines Holdings | -2.06 | 7.99B | 15.13B |

| US | Comerica | 1.59 | 734.04M | 13.28B |

| UK | Alcoa | 2 | 3.34B | 11.49B |

| US | Sterling Bancorp | 0.518 | 250.1M | 5.71B |

| US | Umpquas | 0.4374 | 307.56M | 4.58B |

| Wednesday, January 19, 2021 | ||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. |

| US | Union Pacific | 2.62 | 5.62B | 158.32B |

| US | Intuitive Surgical | 1.28 | 1.51B | 109.94B |

| US | CSX | 0.4135 | 3.32B | 80.82B |

| US | SVB | 6.52 | 1.43B | 41.34B |

| US | Travelers | 3.86 | 7.72B | 40.15B |

| US | PPG Industries | 1.18 | 4.05B | 39.17B |

| US | Fifth Third | 0.899 | 2.02B | 34.50B |

| US | Northern Trust | 1.81 | 1.65B | 27.75B |

| US | KeyCorp | 0.5633 | 1.8B | 25.15B |

| US | Regions Financial | 0.4971 | 1.63B | 24.22B |

| US | Baker Hughes | 0.2781 | 5.49B | 23.89B |

| US | M&T Bank | 3.27 | 1.47B | 23.85B |

| US | American Airlines | -1.54 | 9.31B | 11.97B |

| US | First Horizon National | 0.3292 | 729.82M | 10.07B |

| US | People’s United | 0.3268 | 472.92M | 9.05B |

| US | Synovus | 1.08 | 492.11M | 7.81B |

| US | Bank Ozk | 0.9789 | 273.42M | 6.49B |

| US | Pacific Premier | 0.8357 | 195.31M | 4.18B |

| Thursday, January 20, 2021 | ||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. |

| US | Netflix | 2.62 | 5.62B | 158.32B |

| US | Union Pacific | 1.28 | 1.51B | 109.94B |

| US | Intuitive Surgical | 0.4135 | 3.32B | 80.82B |

| US | CSX | 6.52 | 1.43B | 41.34B |

| US | SVB | 3.86 | 7.72B | 40.15B |

| US | Travelers | 1.18 | 4.05B | 39.17B |

| US | PPG Industries | 0.899 | 2.02B | 34.50B |

| US | Fifth Third | 1.81 | 1.65B | 27.75B |

| US | Northern Trust | 0.5633 | 1.8B | 25.15B |

| US | KeyCorp | 0.4971 | 1.63B | 24.22B |

| US | Regions Financial | 0.2781 | 5.49B | 23.89B |

| US | Baker Hughes | 3.27 | 1.47B | 23.85B |

| US | M&T Bank | -1.54 | 9.31B | 11.97B |

| UK | American Airlines | 0.3292 | 729.82M | 10.07B |

| US | First Horizon National | 0.3268 | 472.92M | 9.05B |

| US | People’s United | 1.08 | 492.11M | 7.81B |

| US | Synovus | 0.9789 | 273.42M | 6.49B |

| US | Bank Ozk | 0.8357 | 195.31M | 4.18B |

| Thursday, January 21, 2021 | ||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. |

| US | Schlumberger | 0.3899 | 6.09B | 53.03B |

| US | Kansas City Southern | 2.16 | 761.57M | 26.71B |

Dividends

| Tuesday, January 18, 2022 | |||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Yield |

| US | APA Corp | 20/01/2022 | 0.13 | USD | 1.5% |

| UK | Compass | 20/01/2022 | 14.00 | GBP | 0.8% |

| US | Cooper | 20/01/2022 | 0.03 | USD | 0.0% |

| US | CVS Health Corp | 20/01/2022 | 0.55 | USD | 2.1% |

| US | Enel Americas ADR | 20/01/2022 | 0.04 | USD | 3.0% |

| UK | Games Workshop | 20/01/2022 | 65.00 | GBP | 3.0% |

| US | Gladstone Land | 20/01/2022 | 0.05 | USD | 1.7% |

| US | LTC Properties | 20/01/2022 | 0.19 | USD | 6.2% |

| US | Parkland Fuel | 20/01/2022 | 0.10 | USD | 3.5% |

| US | Patterson | 20/01/2022 | 0.26 | USD | 3.6% |

| US | Pentair | 20/01/2022 | 0.21 | USD | 1.3% |

| US | PerkinElmer | 20/01/2022 | 0.07 | USD | 0.2% |

| US | Procter&Gamble | 20/01/2022 | 0.87 | USD | 2.2% |

| US | Williams-Sonoma | 20/01/2022 | 0.71 | USD | 1.9% |

| Wednesday, January 19, 2022 | |||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Yield |

| US | Acuity Brands | 19/01/2022 | 0.13 | USD | 0.3% |

| US | Caterpillar | 19/01/2022 | 1.11 | USD | 1.9% |

| US | Commercial Metals | 19/01/2022 | 0.14 | USD | 1.5% |

| US | Zoetis Inc | 19/01/2022 | 0.33 | USD | 0.6% |

| Thursday, January 20, 2022 | |||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Yield |

| US | APA Corp | 20/01/2022 | 0.13 | USD | 1.5% |

| UK | Compass | 20/01/2022 | 14.00 | GBP | 0.8% |

| US | Cooper | 20/01/2022 | 0.03 | USD | 0.0% |

| US | CVS Health Corp | 20/01/2022 | 0.55 | USD | 2.1% |

| US | Enel Americas ADR | 20/01/2022 | 0.04 | USD | 3.0% |

| US | Games Workshop | 20/01/2022 | 65.00 | USD | 3.0% |

| UK | Gladstone Land | 20/01/2022 | 0.05 | GBP | 1.7% |

| UK | LTC Properties | 20/01/2022 | 0.19 | GBP | 6.2% |

| US | Parkland Fuel | 20/01/2022 | 0.10 | USD | 3.5% |

| US | Patterson | 20/01/2022 | 0.26 | USD | 3.6% |

| US | Pentair | 20/01/2022 | 0.21 | USD | 1.3% |

| US | PerkinElmer | 20/01/2022 | 0.07 | USD | 0.2% |

| US | Procter&Gamble | 20/01/2022 | 0.87 | USD | 2.2% |

| US | Williams-Sonoma | 20/01/2022 | 0.71 | USD | 1.9% |

| Friday, January 21, 2022 | |||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Yield |

| US | Aberdeen Income Credit Strategies Fund | 21/01/2022 | 0.10 | USD | 11.6% |

| US | Colgate-Palmolive | 21/01/2022 | 0.45 | USD | 2.2% |

| US | ETV New York MBF | 21/01/2022 | 0.04 | USD | 3.6% |

| US | Getnet Adquirencia ADR | 21/01/2022 | 0.09 | USD | 6.3% |

| US | Keyera Corp. | 21/01/2022 | 0.16 | USD | 6.7% |

| US | Office Properties | 21/01/2022 | 0.55 | USD | 7.9% |

| UK | Putnam Municipal Opportunit Trust | 21/01/2022 | 0.05 | GBP | 4.8% |