Market Review 14/10/2021

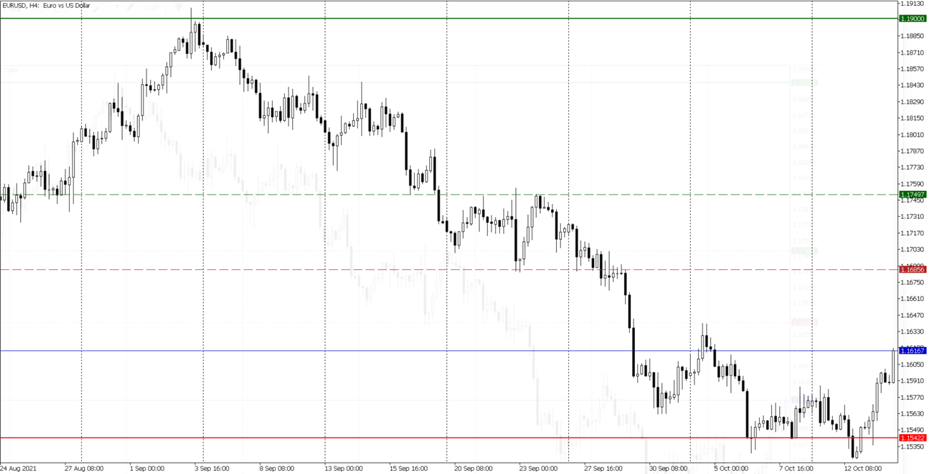

EUR/USD

The 1.1540 level seems to have consolidated as a new support for now as the pair has bounced back above 1.1600. Increasing concern over inflation may be playing a role in this Dollar weaking, though the Federal Reserve staff keeps expecting to be “transitory”. We keep the 1.1900 figure as our strong resistance.

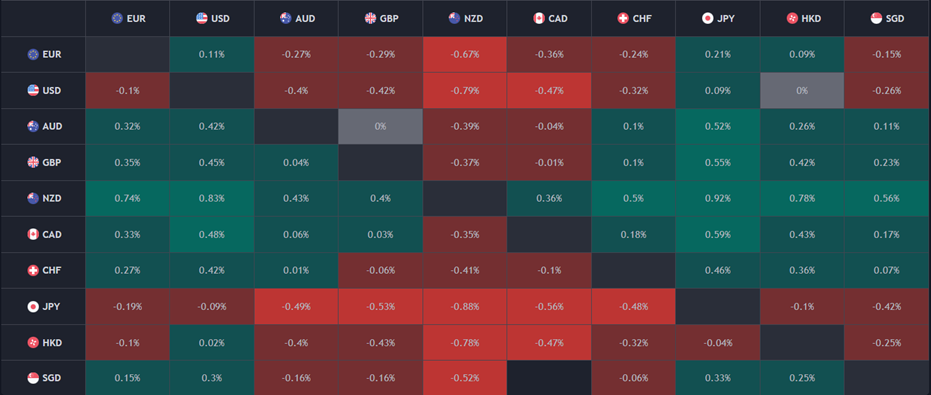

Currency Heatmap

The Currency Heatmap displays a generalized weakening of the US Dollar against almost all major currencies. New Zealand Dollar keeps proving itself as the strongest across the panel, followed by the Canadian Dollar, the Japanese Yen, and the Hong Kong Dollar.

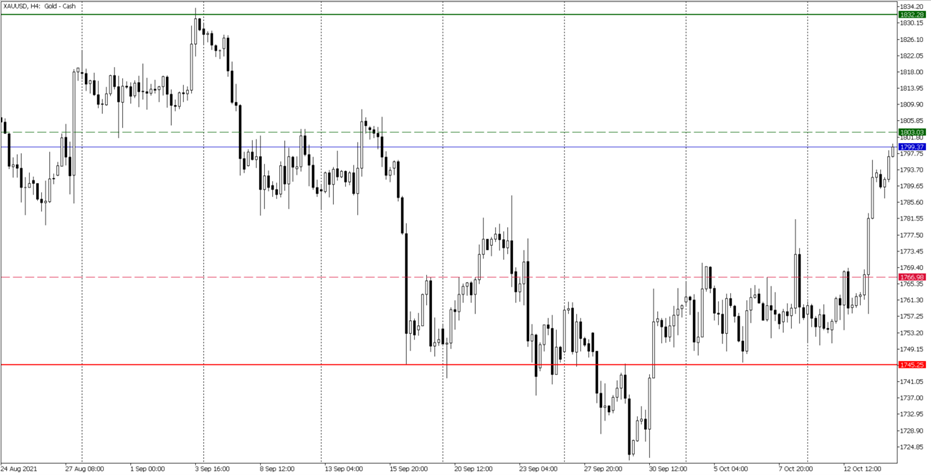

Gold

The precious metal broke out above USD/oz 1,766, which had been the upper level of its trading range for the past two weeks. This had been tested by the price three times over this period. It looks that the price is approaching the key psychological level of USD/oz 1,800, a price last traded a month ago. It seems that the US Dollar weakness caused by the increasing concerns about the “transitory” status of inflation has lifted the price, as investors might still see the precious metal as an inflationary hedge.

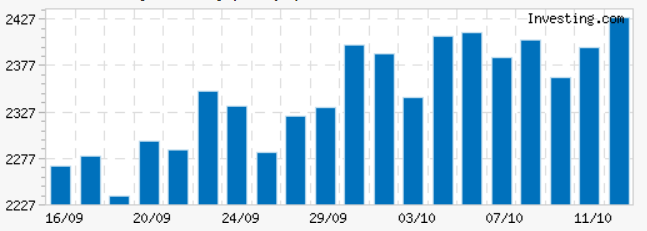

*Source Investing.com Calculator

Volatility has picked back up supported by the strong price movement of the last two days, reaching new maximum levels in a month around 2,427 points. The overall look shows an uptrend that has been gaining momentum over the last month.

Stocks to Watch

Earnings: Below are the stocks to monitor for the rest of the week will announce their earnings.

| Wednesday, October 13, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | JPMorgan (JPM) | 3 | 29.86B | 497.95B | Before Market Open |

| US | BlackRock (BLK) | 9.6 | 4.82B | 127.8B | Before Market Open |

| US | Infosys ADR (INFY) | 0.1678 | 3.94B | 93.92B | Before Market Open |

| US | Wipro ADR (WIT) | 0.0699 | 2.6B | 47.23B | Before Market Open |

| US | Delta Air Lines (DAL) | 0.1614 | 8.41B | 27.54B | Before Market Open |

| UK | Just Eat Takeaway (JETJ) | - | - | 11.53B | -- |

| US | 888 Holdings (888) | - | - | 1.47B | -- |

| Thursday, October 14, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | Taiwan Semiconductor (TSM) | 1.04 | 14.84B | 531.47B | -- |

| US | Bank of America (BAC) | 0.7075 | 21.65B | 368.4B | Before Market Open |

| US | Wells Fargo&Co (WFC) | 0.9953 | 18.22B | 197.11B | Before Market Open |

| US | Morgan Stanley (MS) | 1.69 | 13.93B | 177.51B | Before Market Open |

| US | Citigroup (C) | 1.74 | 17.06B | 145.28B | |

| US | Domino’s Pizza (DOM) | - | - | 13.01B | -- |

| Friday, October 15, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | Honeywell (HON) | 2 | 8.67B | 148.64B | -- |

| US | Goldman Sachs (GS) | 10.11 | 11.72B | 124B | Before Market Open |

| US | Truist Financial Corp (TFC) | 1.09 | 5.52B | 80.4B | Before Market Open |

| UK | Schroders (SDR) | - | - | 8.97B | -- |

| UK | Hargreaves Lansdown (HRGV) | - | - | 6.92B | -- |