Market Update 03/08/2021

EUR/USD

Following the FED’s interest rate decision to keep the rate unchanged we have seen a weaker Dollar, the EURUSD pair has recently tested the 1.1900 handle during the last trading week. Going forward we may see the pair visit the support level around the 1.1850 area before retesting the 1.1900 level. The next area of support stands around the 1.1795 level, with our strong resistance in the 1.1760-1.1752 range. If we see the 1.1900 broken the pair should start to gain some upwards momentum and move towards the resistance at 1.1960.

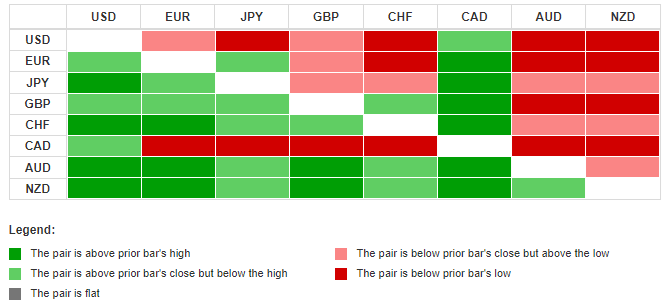

Daily Currency Heatmap

On the Daily currency Heatmap we can see that the Canadian Dollar weakness continues from last week, as well as the US Dollar weakening over the past week. The New Zealand Dollar is showing the most strength against the other pairs, in the recent days.

Gold

Last week following the US Interest rate decision there was a short-term movement to the upside, with gold reaching but unable to break the $1832 resistance. Gold is still currently trading around the $1810 price level; the precious metal is now ranging between the $1832 & the $1792 boundaries. The $1795 - $1792 area serves as our short-term support. The key level of resistance is the $1832 level; a break of this may see gold rise to the $1850 - $1862 range. Our strong support is still in the $1750-$1747 area. I believe the short-term future direction of the Gold depends on which side of the range will be the first to give in.

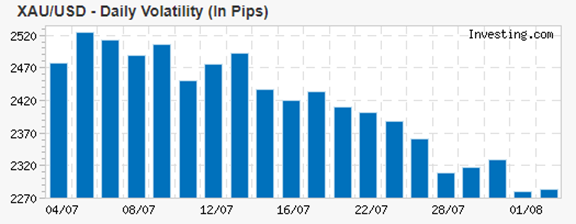

*Source Investing.com Calculator

In the above table we can see that last week as expected we saw a change in the downward trend with a slight increase in the gold volatility against the US dollar, this occurred during the buildup to the FED’s Interest Rate Decision. Since then, this week the market seems to have digested this news and we may see the volatility to continue the previous trend.

Stocks to Watch

Earnings: Below are the stocks to monitor for the rest of the week will announce their earnings.

| Tuesday, August 3, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | Amgen (AMGN) | 4.09 | 6.46B | 137.77B | After Market Close |

| US | Activision Blizzard (ATVI) | 0.7549 | 1.89B | 64.31B | After Market Close |

| UK | BP (BP) | 0.0968 | 38.53B | 60.48B | Before Market Open |

| US | LYFT (LYFT) | -0.2392 | 699.13M | 18.44B | After Market Close |

| UK | Johnson Matthey (JMPLY) | -- | -- | 7.93B | -- |

| UK | Fresnillo (FRES) | 0.45 | 1,430M | 6.08B | Before Market Open |

| US | Avis (CAR) | 1.22 | 1.86B | 6.00B | After Market Close |

| US | Herbalife (HLF) | 1.29 | 1.57B | 5.96B | After Market Close |

| UK | Bank Ireland (BIRG) | -- | -- | 5.02B | Before Market Open |

| US | Nikola (NKLA) | -0.3011 | 16.67K | 4.42B | -- |

| US | Corsair (CRSR) | 0.3872 | 475.23M | 2.67B | Before Market Open |

| Wednesday, August 4, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| UK | Toyota Motor (TYT) | 236.72 | 7.45T | 28.11T | -- |

| US | Booking (BKNG) | -2.04 | 1.89B | 89.12B | After Market Close |

| US | General Motors (GM) | 1.69 | 29.92B | 82.73B | Before Market Open |

| US | Uber Tech (UBER) | -0.5417 | 3.74B | 81.40B | After Market Close |

| US | Roku (ROKU) | 0.122 | 618.82M | 55.79B | After Market Close |

| US | MetLife (MET) | 1.68 | 15.84B | 50.63B | After Market Close |

| US | MGM (MGM) | -0.3807 | 2.16B | 18.33B | After Market Close |

| US | AMC Entertainment (AMC) | -0.9574 | 367.46M | 17.67B | -- |

| Thursday, August 5, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | Moderna (MRNA) | 5.96 | 4.21B | 139.17B | -- |

| UK | Deutsche Post (0H3Q) | 0.95 | 18.42B | 70.55B | Before Market Open |

| UK | Bayer (0P6S) | 1.54 | 10.15B | 49.67B | Before Market Open |

| US | Monster Beverage (MNST) | 0.678 | 1.39B | 49.35B | After Market Close |

| US | Zynga (ZNGA) | 0.0915 | 715.88M | 10.95B | After Market Close |

Dividends: The following stocks will be paying dividends over this week.

| Thursday, August 5, 2021 | Stock | Ex Div Date | Dividend | Type | Yield |

| US | Intel (INTC) | 5-Aug-21 | 0.3475 | Quarterly | 2.59% |

| UK | Lloyds Banking (LLOY) | 5-Aug-21 | 0.67 | 12 months trailing | 1.47% |

| UK | Reckitt Benckiser (RKT) | 5-Aug-21 | 174.6 | 12 months trailing | 3.16% |

| UK | Relx (REL) | 5-Aug-21 | 47.7 | 12 months trailing | 2.26% |

| UK | Rentokil (RTO) | 5-Aug-21 | 7.5 | 12 months trailing | 1.32% |

| UK | Unilever (ULVR) | 5-Aug-21 | 149.09 | 12 months trailing | 3.59% |

| US | Wells Fargo&Co (WFC) | 5-Aug-21 | 0.2 | Quarterly | 1.74% |

| Friday, August 6, 2021 | Stock | Ex Div Date | Dividend | Type | Yield |

| US | Apple (AAPL) | 6-Aug-21 | 0.22 | Quarterly | 0.60% |