Market Update 03/12/2021

EUR/USD

The EUR/USD pair reached down to the low at 1.1190 area, after touching this level of suport it has been gaining some bullish momentum. The pair is currently trading close to one of our levels of short term resistance in the 1.1330-1.1300 range. Our current resistance stands at the 1.1460-1.1480 area. A breakeout to the upside may see the pair move to test the more distant resistance at 1.16600, the main level of resistance can still be seen at the 1.1700 handle. Our strong support still stands the 1.12000 - 1.1180 range. Will the NFP and US unemployment figure about to be released, how will the market react to the actual data?

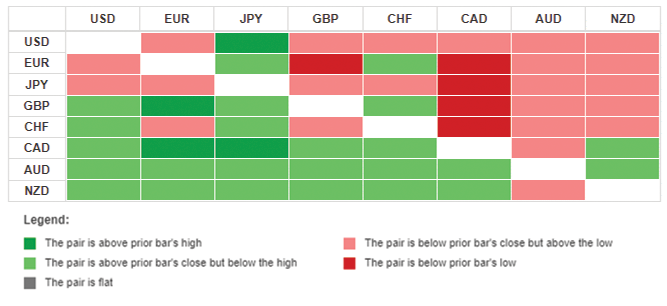

5 Hour Currency Heatmap

The Currency Heatmap shows how the Australian Dollar has continued this week to be the strongest currency vs all of the other major currencies. The Japanese Yen still proving to be the weakest against all other pairs except across the board.

Gold

Gold is trading at $1,773, the precious metal has moved down since testing the $1,865 resistance, since then it has reached down to test the support at the $1,762 area. Now that we have seen the correction after the fast move up, we may be on the way to see the price of Gold continue to rise. Will we see a possible re-test of the $1,865 price before it continues higher? The level of strong support currently stands within the $1,760 - $1,745, a break of the support may see the price of Gold drifting back down towards the $1,725level. With the NFP news and unemployment data being released today we can anticipate an increase in volatility

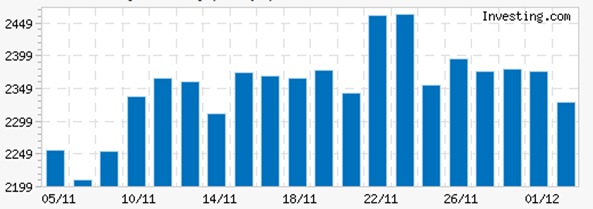

*Source Investing.com Volatility Calculator

Volatility was gradually increasing since the low seen on the 07/11/2021, reaching its peak on the 12/11/2021 aroung the 2460 points mark. Since then we have seen a slight decline in the volatility.

Stocks News Announcements

This Weeks Earnings:

| Monday, November 29, 2021 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | Time |

| UK | British American Tobacco | -- | -- | 58.37B | -- |

| US | Li Auto | -0.0972 | 7.26B | 32.92B | Before Market Open |

| US | POSCO | 5.87 | 17.4B | 17.2B | -- |

| UK | Legal & General | -- | -- | 16.90B | -- |

| UK | Playtech | -- | -- | 2.22B | -- |

| US | Cronos | -0.09 | 20.02M | 1.74B | -- |

| US | Score Media and Gaming | -0.1127 | 8.26M | 1.53B | -- |

| US | Grupo Simec ADR | 0.8977 | 754.93M | 1.17B | -- |

| US | Ferroglobe | -0.22 | -- | 1.16B | -- |

| US | American Realty Investors | 1.2 | 10.49M | 180.90M | -- |

| UK | SPI Energy | -- | -- | 127.79M | -- |

| UK | Kronos Advanced Tech | -- | -- | 26.98M | -- |

| US | Washington Prime | -1.67 | 129.89M | 20.36M | -- |

| Tuesday, November 30, 2021 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | Time |

| US | Salesforce.com | 0.9219 | 6.8B | 278.24B | After Market Close |

| UK | Globalfoundries | -0.0107 | 1.7B | 35.98B | After Market Close |

| US | NetApp | 1.21 | 1.55B | 19.75B | After Market Close |

| US | Hewlett Packard | 0.4873 | 7.38B | 18.88B | -- |

| US | Ambarella | 0.4863 | 90.33M | 6.31B | After Market Close |

| UK | EasyJet | 0.38 | 1.13B | 3.88B | Before Market Open |

| UK | Pennon | 23.48 | 309.81M | 3.39B | -- |

| US | Hello Group | 1.49 | 3.69B | 2.57B | Before Market Open |

| UK | Shaftesbury | 3.15 | 48.95M | 2.48B | -- |

| US | Frontline | -0.1696 | 74.63M | 1.38B | Before Market Open |

| US | Baozun Inc | -0.033 | 1.93B | 1.18B | -- |

| US | Chicos FAS | -0.025 | 426.1M | 696.83M | -- |

| UK | Greencore | 6.00 | 330.6M | 644.02M | -- |

| UK | Redwire | -0.05 | 40M | 563.26M | -- |

| UK | Marston’s | -- | -- | 457.86M | -- |

| Wednesday, December 1, 2021 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | Time |

| US | RBC | 2.81 | 11.69B | 144.65B | Before Market Open |

| US | Snowflake | -0.0567 | 305.62M | 109.11B | After Market Close |

| US | Synopsys | 1.79 | 1.15B | 52.18B | After Market Close |

| US | Veeva Systems A | 0.8777 | 465.96M | 44.43B | After Market Close |

| US | Splunk | -0.5335 | 642.99M | 20.17B | After Market Close |

| US | Five Below | 0.2907 | 562.19M | 11.47B | After Market Close |

| UK | Rolls-Royce Holdings | -- | -- | 10.31B | -- |

| US | PVH | 2.07 | 2.4B | 7.82B | After Market Close |

| US | C3 Ai | -0.2939 | 56.95M | 4.00B | After Market Close |

| US | Patterson | 0.5038 | 1.58B | 3.08B | Before Market Open |

| UK | Redrow | -- | -- | 2.26B | -- |

| UK | Drax Group | -- | -- | 2.26B | -- |

| UK | Serco | -- | -- | 1.61B | |

| US | G-III Apparel | 1.78 | 1.01B | 1.49B | Before Market Open |

| US | Missfresh | -0.62 | 314.42M | 1.24B | -- |

| UK | Spire Healthcare | -- | -- | 940.01M | -- |

| UK | Capita | -- | -- | 762.47M | -- |

| UK | Petrofac | -- | 585.23M | -- | |

| US | ETV New York MBF | -- | 220.68M | -- | |

| UK | Galliford Try | -- | 185.15M | -- | |

| US | Trans-Siberian Gold | -- | 102.41M | -- | |

| Thursday, December 2, 2021 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | Time |

| US | Marvell | 0.3848 | 1.15B | 59.29B | -- |

| US | Dollar General | 2 | 8.48B | 52.36B | Before Market Open |

| US | Canadian Imperial Bank | 3.53 | 5.09B | 51.70B | Before Market Open |

| US | Kroger | 0.6604 | 31.14B | 32.08B | -- |

| US | Ulta Beauty | 2.44 | 1.88B | 21.72B | After Market Close |

| US | Cooper | 3.38 | 748.63M | 18.73B | After Market Close |

| US | Elastic | -0.1576 | 194.57M | 14.16B | -- |

| US | Signet Jewelers | 0.7131 | 1.42B | 5.47B | Before Market Open |

| US | Ollies Bargain Outlet Holdings Inc | 0.4703 | 415.22M | 4.20B | After Market Close |

| Friday, December 3, 2021 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | Time |

| US | Bank of Montreal | 3.19 | 6.56B | 69.69B | Before Market Open |

| US | DocuSign | 0.4608 | 532.61M | 49.11B | -- |

| US | Zuora | -0.03 | 86.56M | 2.46B | -- |

| US | Big Lots | -0.1553 | 1.32B | 1.49B | -- |

| US | Genesco | 1.29 | 575.57M | 953.84M | Before Market Open |

This Weeks Dividends:

| Monday, November 29, 2021 | ||||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Type | Yield |

| US | San Juan Basin Royalty Trust | 29/11/2021 | 0.05545 | USD | Quarterly | 8.88% |

| US | Permianville Royalty | 29/11/2021 | 0.007875 | USD | Monthly | 4.24% |

| US | Neuberger Berman New York | 29/11/2021 | 0.039333333 | USD | Monthly | 3.65% |

| US | Interstate Power | 29/11/2021 | 0.31875 | USD | Three Months | 5.04% |

| US | Farmers Long Beach | 29/11/2021 | 108 | USD | Twelve Months | 1.31% |

| US | Energizer | 29/11/2021 | 0.3 | USD | Twelve Months | 3.10% |

| US | DTE Energy Co | 29/11/2021 | 0.375 | USD | Three Months | 5.91% |

| US | Customers Bancorp Pref E | 29/11/2021 | 0.33215 | USD | Three Months | 5.22% |

| US | Brookfield Infrastructure Partners | 29/11/2021 | 0.51 | USD | Three Months | 3.57% |

| US | Artis REIT | 29/11/2021 | 0.479578 | USD | Twelve Months | 5.15% |

| Thusday, November 30, 2021 | ||||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Type | Yield |

| US | Stifel | 30/11/2021 | 0.15 | USD | Three Months | 0.78% |

| US | Steel Partners Holdings Pref | 30/11/2021 | 0.375 | USD | Three Months | 6.24% |

| US | Star Equity Prf | 30/11/2021 | 0.25 | USD | Three Months | 9.90% |

| US | Stanley Black Decker | 30/11/2021 | 0.79 | USD | Three Months | 1.73% |

| US | SS&Cs | 30/11/2021 | 0.2 | USD | Three Months | 1.02% |

| US | South Jersey Industries | 30/11/2021 | 0.351575 | USD | Three Months | 5.38% |

| US | SK Telecom ADR | 30/11/2021 | 0.5674 | USD | Six Months | 3.63% |

| US | Sinclair | 30/11/2021 | 0.2 | USD | Three Months | 3.25% |

| US | Safety Insurance | 30/11/2021 | 0.9 | USD | Three Months | 4.52% |

| US | Reinsurance Group of America | 30/11/2021 | 0.359375 | USD | Three Months | 5.01% |

| US | Regions Financial Corp Pb ADR | 30/11/2021 | 0.39845 | USD | Three Months | 5.59% |

| US | Realty Income | 30/11/2021 | 0.246 | USD | One Month | 4.13% |

| US | Prospect Capital | 30/11/2021 | 0.4297 | USD | Three Months | 6.62% |

| US | People’s United Fin | 30/11/2021 | 0.351575 | USD | Three Months | 5.02% |

| US | PennyMac Mortgage Pref B | 30/11/2021 | 0.5 | USD | Three Months | 7.58% |

| US | PennyMac Mortgage Investment Trust Prf C | 30/11/2021 | 0.5203 | USD | Three Months | 8.26% |

| US | MVB Financial | 30/11/2021 | 0.15 | USD | Three Months | 1.42% |

| US | ManpowerGroup | 30/11/2021 | 1.26 | USD | Three Months | 2.56% |

| US | Kimberly-Clark de Mexico | 30/11/2021 | 0.523303 | USD | One Year | 6.80% |

| US | Element Solutions | 30/11/2021 | 0.08 | USD | Three Months | 1.29% |

| US | Ebix | 30/11/2021 | 0.075 | USD | Three Months | 0.95% |

| US | eBay | 30/11/2021 | 0.18 | USD | Three Months | 0.99% |

| US | Diana Shipping | 30/11/2021 | 0.1 | USD | Three Months | 9.28% |

| US | DCP Midstream Pref B | 30/11/2021 | 0.4922 | USD | Three Months | 7.86% |

| US | Brookfield Property Partners LP | 30/11/2021 | 0.40625 | USD | Three Months | 6.35% |

| US | Ashford Hospitality Pref | 30/11/2021 | 1.875 | USD | Twelve Months | 6.99% |

| Thusday, December 2, 2021 | ||||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Type | Yield |

| US | United Fire | 02/12/2021 | 0.15 | USD | Three Months | 2.68% |

| UK | UIL | 02/12/2021 | 8 | GBP | Three Months | 3.25% |

| UK | Royal Mail | 02/12/2021 | 16.7 | GBP | Three Months | 3.47% |

| UK | Real Estate Credit | 02/12/2021 | 12 | GBP | Three Months | 7.82% |

| UK | Premier Global | 02/12/2021 | 7.95 | GBP | Three Months | 4.04% |

| US | Pick N Pay ADR | 02/12/2021 | 0.712505 | USD | Three Months | 3.69% |

| UK | Pets at Home Group PLC | 02/12/2021 | 9.8 | GBP | Three Months | 2.03% |

| US | Petroleo Brasileiro Petrobras ADR | 02/12/2021 | 0.3218127 | USD | Three Months | 3.07% |

| US | Orange County Bancorp | 02/12/2021 | 0.2 | USD | Three Months | 2.14% |

| US | Open Text | 02/12/2021 | 0.2209 | USD | Three Months | 1.83% |

| UK | Octopus Titan VCT | 02/12/2021 | 5 | GBP | Three Months | 4.61% |

| US | Octopus Titan VCT | 02/12/2021 | 2 | USD | Twelve Months | 10.14% |

| UK | Montanaro Smaller Companies | 02/12/2021 | 0.93 | GBP | Three Months | 0.42% |

| US | Jupiter Emerging & Frontier | 02/12/2021 | 4.45 | USD | Three Months | 4.29% |

| US | Invesco Mortgage Capital Pb Pref | 02/12/2021 | 0.4844 | USD | Three Months | 7.66% |

| US | Grindrod Shipping | 02/12/2021 | 0.72 | USD | Three Months | 19.55% |

| UK | First Property | 02/12/2021 | 0.7 | GBP | Twelve Months | 2.03% |

| Friday, December 3, 2021 | ||||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Type | Yield |

| US | Red River Bancshares | 03/12/2021 | 0.07 | USD | Three Months | 0.0052 |