Market Update 05/01/2021

Dow posts closing record high

The S&P 500 ended slightly weaker after hitting an intraday all-time high. Declines in shares of big growth names including Tesla Inc weighed on the index and the Nasdaq Composite, which ended down more than 1%. Economically sensitive energy, financials and industrials were the leading sectors in the S&P 500, with financials eking out an all-time closing high. Helping sentiment, the World Health Organization cited increasing evidence that the coronavirus variant caused milder symptoms than previous variants. Earlier, U.S. manufacturing data for December showed some cooling in demand for goods, but investors took solace in signs of supply constraints easing. The S&P 500 bank index rose 3.5% in its biggest daily percentage gain in about a year.

US500

Rising U.S. yields hit tech stocks

Asian stocks fell on Wednesday as higher U.S. Treasury yields weighed on global tech firms and pushed the dollar to a five-year high against Japan's yen. U.S. yields rose on Tuesday as bond investors geared up for interest rate hikes from the Federal Reserve by mid-year to curb stubbornly high inflation. The shift in market focus back to prospect for U.S. interest rate hikes has revived a rotation out of growth-sensitive stocks, such as tech firms, into ones that offer income, such as financials and industrials.

Oil steadies

Oil prices steadied on Wednesday as investors assessed the impact of a massive spike in COVID-19 cases caused by the Omicron variant, though the upside remained limited after U.S. fuel inventories climbed. Brent crude futures fell 4 cents, or 0.03%, to $80.04 a barrel by 0716 GMT, while U.S. West Texas Intermediate (WTI) crude futures rose 2 cents, or 0.03%, to $77.01 a barrel. The United States reported nearly 1 million new coronavirus infections on Monday, the highest daily tally of any country in the world and nearly double the previous U.S. peak set a week ago.

Brent oil

Crude oil

Cryptocurrencies News

Bitcoin (BTC) witnessed a roller coaster ride in 2021 and even though BTC has corrected sharply from its all-time high at $69,000, the digital asset is still up by 60% year-to-date. During the same period, gold has dropped more than 5%

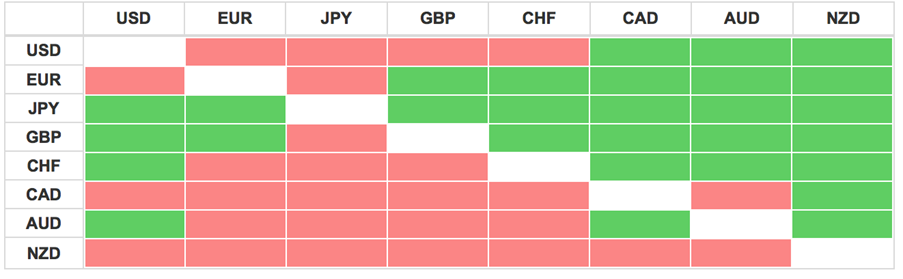

Daily Currencies Heat Map

*Source Investing.com

- The U.S. Dollar Index that tracks the greenback against a basket of other currencies inched down 0.04% to 96.240 by 10:17 PM ET (3:17 AM GMT).

- The USD/JPY pair edged down 0.18% to 115.93.

- The AUD/USD pair edged down 0.13% to 0.7229 and the NZD/USD pair was down 0.21% to 0.6798.

Earnings

| Wednesday, January 5, 2022 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | |

| US | RPM | 0.8129 | 1.55B- | 13.10B | |

| Thursday, January 6, 2022 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | |

| US | RPM | 0.8129 | 1.55B | 13.10B | |

| US | Constellation Brands A | 2.81 | 2.28B | 47.05B | |

| US | Walgreens Boots | 1.35 | 32.46B | 45.06B | |

| US | ConAgra Foods | 0.6798 | 3.02B | 16.38B | |

| US | Helen of Troy Ltd | 3.18 | 554.2M | 5.90B | |

| US | Bed Bath&Beyond | 0.0177 | 1.96B/td> | 1.46B | |

| Friday, January 7, 2022 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | |

| US | Acuity Brands | 2.42 | 880.24M | 7.32B | |

Dividends

| Monday, January 3, 2022 | ||||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Yield | |

| US | Agilent Technologies | 01/03/2022 | 0.21 | USD | 0.0053 | |

| US | Dollar General | 01/03/2022 | 0.42 | USD | 0.0071 | |

| US | Physicians Realty Trust | 01/03/2022 | 0.23 | USD | 0.0489 | |

| US | Quanta Services | 01/03/2022 | 0.07 | USD | 0.0024 | |

| US | Raymond James Financial | 01/03/2022 | 0.34 | USD | 0.0135 | |

| Tuesday, January 4, 2022 | ||||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Yield | |

| US | Aecom Technology | 01/04/2022 | 0.15 | USD | 0.0078 | |

| US | Cisco | 01/04/2022 | 0.37 | USD | 0.0234 | |

| US | Comcast | 01/04/2022 | 0.25 | USD | 0.0199 | |

| US | Gap | 01/04/2022 | 0.12 | USD | 0.0272 | |

| US | NewYork Times | 01/04/2022 | 0.07/td> | USD | 0.0058 | |

| US | Orion Engineered Carbons | 01/04/2022 | 0.02 | USD | 0.0044 | |

| Wednesday, January 5, 2022 | ||||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Yield | |

| US | Campbell Soup | 01/05/2022 | 0.37 | USD | 0.03 | |

| US | Heico A | 01/05/2022 | 0.09 | USD | 0.00 | |

| US | Heico | 01/05/2022 | 0.09 | USD | 0.00 | |

| US | JPMorgan | 01/05/2022 | 1.00 | USD | 0.03 | |

| US | Keurig Dr Pepper | 01/05/2022 | 0.19 | USD | 0.02 | |

| US | Trinseo SA | 01/05/2022 | 0.32 | USD | 0.02 | |

| Thursday, January 6, 2022 | ||||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Yield | |

| UK | Aveva | 01/06/2022 | 13.00 | GBP | 0.01 | |

| UK | Brewin Dolphin | 01/06/2022 | 11.10 | GBP | 0.04 | |

| US | Bristol-Myers Squibb | 01/06/2022 | 0.54 | USD | 0.03 | |

| UK | Experian | 01/06/2022 | 0.116 | GBP | -- | |

| UK | Ferrexpo | 01/06/2022 | 0.07 | GBP | -- | |

| US | Gentex | 01/06/2022 | 0.012/td> | USD | 0.01 | |

| US | Globe Life | 01/06/2022 | 0.20 | USD | 0.01 | |

| US | Globe Life | 01/06/2022 | 2.00 | USD | 0.04 | |

| US | Marvell | 01/06/2022 | 0.06 | USD | 0.00 | |

| US | Mastercard | 01/06/2022 | 0.49 | USD | 0.01 | |

| US | NetApp | 01/06/2022 | 0.50 | USD | 0.02 | |

| US | Oracle | 01/06/2022 | 0.32 | USD | 0.01 | |

| US | Owens Corning | 01/06/2022 | 0.35 | USD | 0.02 | |

| US | Progressive | 03/12/2021 | 0.10 | USD | 0.00 | |

| UK | Qinetiq | 03/12/2021 | 2.30 | GBP | 0.03 | |

| US | Royal Gold | 03/12/2021 | 0.35 | USD | 0.01 | |

| US | Sysco | 03/12/2021 | 0.47 | USD | 0.02 | |

| US | Toll Brothers | 03/12/2021 | 0.17 | USD | 0.01 | |

| UK | Workspace | 03/12/2021 | 7.00 | GBP | 0.03 | |

| Friday, January 7, 2022 | ||||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Yield | |

| US | AT&T | 01/07/2022 | 0.52 | USD | 0.08 | |

| US | Darden Restaurants | 01/07/2022 | 1.10 | USD | 0.03 | |

| US | General Mills | 01/07/2022 | 0.51 | USD | 0.03 | |

| US | Intuit | 01/07/2022 | 0.68 | USD | 0.00 | |

| US | Lincoln National | 01/07/2022 | 0.45 | USD | 0.03 | |

| US | Roper Technologies | 01/07/2022 | 0.62 | USD | 0.01 | |

| FR | Stone Harbor | 01/07/2022 | 0.06 | USD | 0.011 | |

| US | UDR | 01/07/2022 | 0.36 | USD | 0.02 | |

| US | Verizon | 01/07/2022 | 0.64 | USD | 0.05 | |