Market Update 10/12/2021

Oil Prices Sit Tight

Oil prices drifted in a narrow range on Friday, on track to their biggest weekly gain since late August, as the easing concerns over the Omicron coronavirus variant on global growth and fuel demand drove market sentiment. Prices are under pressure as China's domestic air traffic, once the world's envy after a fast rebound during the pandemic, is faltering amid a zero-COVID policy that has led to tighter travel rules in Beijing and weaker consumer confidence after repeated small outbreaks.

Brent oil

Crude oil

Wall Street Closes Lower

Wall Street closed lower on Thursday as investors banked some profits after three straight days of gains and turned their focus toward upcoming inflation data and how it might influence the Federal Reserve's meeting next week. The Nasdaq was down more sharply than the S&P 500 while the Dow was virtually flat, ending down less than 1 point. Investors were in a waiting game ahead of U.S. consumer prices index (CPI) inflation data due Friday morning. A higher-than-expected reading would strengthen the case for a policy tightening decision at the U.S. central bank's meeting.

CPI Announcement

President Joe Biden, bracing for another jump in inflation, sought to reassure Americans on Thursday that rises in energy costs and other key goods were starting to ease, but said the change might not be reflected in November data due on Friday. The consumer price index (CPI) for November is expected to have risen 6.8% compared with the same month last year, a Reuters poll of economists showed, overtaking a 6.2% increase in October, which was the fastest gain in 31 years.

US Dollar Gains

EUR/USD

World stock markets stalled at two-week highs and oil prices fell on Thursday as increased restrictions in parts of the world to contain the spread of the Omicron COVID-19 variant tempered investor optimism about the economic recovery.

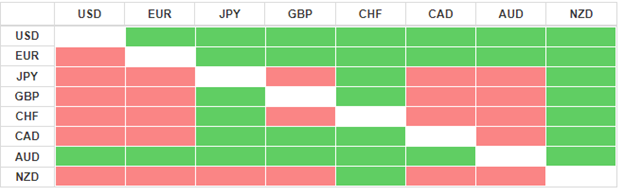

Daily Currency Heatmap

As we can see above that the Australian Dollar and the US Dollar continue to outperform the other major currencies. The New Zealand Dollar shows the most weakness across the board.

Earnings

| Company | Symbol | EPS Forecast | Revenue Forecast | Market Cap |

| H&R Block | HRB | -0.94 | 163.68M | 4.15B |

Dividends

| Company | Symbol | Ex-Dividend Date | Dividend | Yield |

| FedEx | FDX | 10-12-21 | 0.75 | 0.0122 |

| Fidelity National Info | FIS | 10-12-21 | 0.39 | 0.0149 |

| National Beverage | FIZZ | 10-12-21 | 3 | 0.0582 |

| PIMCO California Municipalome III | PZC | 10-12-21 | 0.038 | 0.0421 |

| Spirit Aerosystems | SPR | 10-12-21 | 0.01 | 0.001 |

| Stone Harbor Emerging Marketsome | EDF | 10-12-21 | 0.06 | 0.1076 |