Market Update 11/08/2021

EUR/USD

Following the NFP results, there has been a lot of US dollar strength across the FX markets affecting most pairs including the EURUSD. We have seen the EURUSD pair break the 1.1795 support trading downwards as low as the 1.1710 to 1.1700 range, this area is a level of strong support. A break in the 1.1700 may see the pair moving lower in the long term. Our strong resistance is still the 1.1900 handle. If we see the 1.1900 broken the pair should start to gain some upwards momentum and move towards the 1.1960 level.

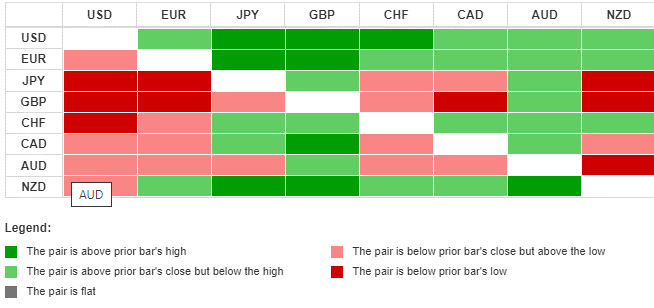

Daily Currency Heatmap

On the Daily currency Heatmap we can see that the New Zealand Dollar weakness. The US Dollar is showing the most strength against the other pairs in the recent days, continued after the NFP announcement on Friday.

Gold

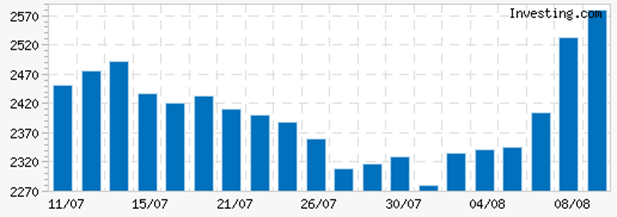

Last week following the NFP results we saw a sharp decline in the price of the precious metal vs the US Dollar, gold reached the lower boundary of the boundary of the range it was trading within, swiftly breaking the $1795 & $1750 support levels before crashing after the weekend trading as low as $1682.20. Gold is currently trading around the $1737 price level. The $1682 area serves as our short-term support. The key level of resistance is the $1792 level; a break of this may see gold rise to the $1800 price level. In the short term will gold trade down towards the $1680 level, before starting its recovery?

*Source Investing.com Calculator

In the above table we can see that last week as expected we saw a change in the downward trend with an increase in the gold volatility against the US dollar, pushing past the June highs. After Friday’s NFP results we saw gold “mini crash”, This increase in volatility may most likely continue in the short term as the market settles down.

Stocks to Watch

Earnings: Below are the stocks to monitor for the rest of the week will announce their earnings.

| Wednesday, August 11, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | eBay (EBAY) | 0.9591 | 3B | 45.86B | After Market Close |

| US | EON SE (EONGY) | 0.1216 | 16.42B | 32.5B | Before Market Open |

| US | Lenovo Group (LNVGF) | 0.0299 | 15.99B | 11.58B | -- |

| US | Aspen (AZPN) | 1.47 | 208.14M | 9.89B | Before Market Open |

| US | Avast (AVASF) | -- | -- | 8.12B | Before Market Open |

| US | Johnson Matthey (JMPLY) | -- | -- | 8.01B | -- |

| US | Bumble (BMBL) | -0.0013 | 178.07M | 5.59B | After Market Close |

| US | Riot Blockchain (RIOT) | 0.0661 | 30.95M | 3.63B | -- |

| US | Blink Charging (BLNK) | -0.162 | 2.58M | 1.55B | After Market Close |

| US | Lordstown Motors (RIDE) | -0.4633 | 0.00 | 1.03B | Before Market Open |

| Thursday, August 12, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | Walt Disney (DIS) | 0.5454 | 16.76B | 321.72B | After Market Close |

| US | Airbnb (ABNB) | -0.3606 | 1.26B | 90B | After Market Close |

| UK | Deutsche Telekom AG (0MPH) | 0.3421 | 26.18B | 84.81B | Before Market Open |

| US | Baidu (BIDU) | 13.18 | 30.99B | 58.54B | Before Market Open |

| US | Palantir (PLTR) | 0.0345 | 359.82M | 43.09B | Before Market Open |

| US | Xpeng (XPEV) | -1.2 | 3.39B | 36.06B | -- |

| UK | Aviva (AV) | 26.56 | 24,375M | 15.83B | Before Market Open |

| US | SoFi Technologies (SOFI) | -0.045 | 231M | 13.44B | After Market Close |

| CAD | Altus Group (AIF) | 0.6634 | 175.28M | 2.49B | After Market Close |

| Friday, August 13, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | FUJIFILM Holdings Corp (FUJIY) | 0.5928 | 5.03B | 28.7B | -- |

| US | CareMax (CMAX) | -0.04 | 114.54M | 677.46M | Before Market Open |

Dividends: The following stocks will be paying dividends over this week.

| Wednesday, August 11, 2021 | Stock | Ex Div Date | Dividend | Type | Yield |

| US | Provident (PROV) | 11-Aug-21 | 0.14 | Quarterly | 3.28% |

| US | Starbucks (SBUX) | 11-Aug-21 | 0.45 | Quarterly | 1.53% |

| Thursday, August 12, 2021 | Stock | Ex Div Date | Dividend | Type | Yield |

| UK | AstraZeneca (AZN) | 12-Aug-21 | 202.20 | 12 months trailing | 2.47% |

| UK | Barclays (BARC) | 12-Aug-21 | 3.00 | 12 months trailing | 1.63% |

| UK | BP (BP) | 12-Aug-21 | 14.82 | 12 months trailing | 4.85% |

| UK | Domino’s Pizza (DOM) | 12-Aug-21 | 12.10 | 12 months trailing | 2.88% |

| UK | Evraz (EVRE) | 12-Aug-21 | 75.39 | 12 months trailing | 12.18% |

| US | Exxon Mobil (XOM) | 12-Aug-21 | 0.87 | Quarterly | 6.08% |

| UK | Fresnillo (FRES) | 12-Aug-21 | 23.81 | 12 months trailing | 3.04% |

| UK | NatWest Group (NWG) | 12-Aug-21 | 6.00 | 12 months trailing | 2.77% |

| UK | Next (NXT) | 12-Aug-21 | 110.00 | 12 months trailing | - |

| UK | Pearson (PSON) | 12-Aug-21 | 19.80 | 12 months trailing | 2.49% |

| US | Visa A (V) | 12-Aug-21 | 0.32 | Quarterly | 0.53% |

| US | Walmart (WMT) | 12-Aug-21 | 0.55 | Quarterly | 1.51% |