Market Update 13/12/2021

Brent and WTI post biggest gains in 15 weeks

Oil prices rose slightly on Friday and posted their biggest weekly gain since late August, with market sentiment buoyed by easing concerns over the Omicron coronavirus variant's impact on global economic growth and fuel demand. The Brent and U.S. West Texas Intermediate (WTI) crude benchmarks each posted gains of about 8% this week, their first weekly gain in seven, even after a brief bout of profit-taking. Brent futures settled higher 73 cents, or 1%, at $75.15 a barrel, after falling 1.9% on Thursday. WTI rose 73 cents, or 1%, to $71.67 after sliding 2% in a volatile session the previous day.

Crude Oil

Brent Oil

Consumer Prices Increased

U.S. consumer prices rose solidly in November as Americans paid more for food and a range goods, leading to the largest annual gain since 1982, posing a political nightmare for President Joe Biden's administration and cementing expectations for the Federal Reserve to start raising interest rates next year.

The report from the Labor Department on Friday, which followed on the heels of a slew of data this month showing a rapidly tightening labor market, makes it likely the U.S. central bank will announce that it is speeding up the wind-down of its massive bond purchases at its policy meeting next week.

The consumer price index increased 0.8% last month after surging 0.9% in October. The broad-based rise was led by gasoline prices, which increased 6.1%, matching October's gain. With crude oil prices declining recently, gasoline prices have likely peaked for now.

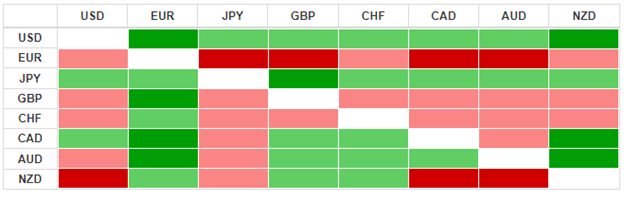

Daily Currency Heatmap

The table below shows the devaluation of Euro against other currencies.

The US dollar inched higher at the start of a busy week of central bank meetings, including at the Federal Reserve, which are expected to drive currency markets and help the dollar, although concerns about the coronavirus weigh heavily on traders' minds.

The Pound lost 0.16% to $1.3257 after British Prime Minister Boris Johnson said on Sunday that Britain faces a "tidal wave" of the Omicron variant of coronavirus and that two vaccine doses will not be enough to contain it.

The Euro slipped 0.17% to $1.1292, while the greenback gained 0.1% on the yen to 113.5.

Moves were muted, however, compared with the last two weeks when news of the new coronavirus variant caused sharp swings in currencies along with other major asset classes.

Todays’ Earnings

| Company | Symbol | EPS Forecast | Revenue Forecast | Market Cap |

| H&R Block | HRB.US | -0.94 | 163.68M | 4.14B |

Today’s Dividends

| Company | Symbol | Ex-Dividend Date | Dividend | Yield |

| Best Buy | BBY.US | 13-Dec-21 | 0.7 | 0.027 |

| BNY Mellon Strategic Municipal Bond Fund | DSM.NL | 13-Dec-21 | 0.03 | 0.0433 |

| BNY Mellon Strategic Municipals | LEO.GY | 13-Dec-21 | 0.03 | 0.0428 |

| Ecolab | ECL.US | 13-Dec-21 | 0.51 | 0.0088 |

| HCA | HCA.US | 13-Dec-21 | 0.48 | 0.0079 |

| Prologis | PLD.US | 13-Dec-21 | 0.63 | 0.0158 |