Market Update 19/07/2021

EUR/USD

After testing the support at the 1.1805-1.1795 price level the EURUSD pair has recently broken below this level currently trading around 1.1768, after breaking the resistance at this level we may see the pair moving towards the next level of support is around the 1.1705 -1.1700 price level. The next level of resistance currently is in the 1.1880-1.1900 range. The focus for this week will be primarily on the high impact economic news announcements, with Thursday’s ECB monetary policy statement and Interest rate decision, the EUR/USD pair as well as all other EUR pair may see some short-term high volatility, depending on the outcome.

Key Economic Data

Below is the high impact news for this week, do not allow yourself to be caught out by high impact forex news.

| Date | Event | Time (GMT+3) | Forecast | Previous |

| Tuesday, July 20, 2021 | ||||

| AUD | RBA Meeting Minutes | 04:30 | - | - |

| CNY | PBoC Loan Prime Rate | 04:30 | - | 3.85% |

| USD | Building Permits (Jun) | 15:30 | 1.700M | |

| Wednesday, July 21, 2021 | ||||

| AUD | Retail Sales (MoM) | 04:30 | -0.50% | 0.40% |

| USD | Crude Oil Inventories | 17:30 | -4.359M' | -7.897M' |

| Thursday, July 22, 2021 | ||||

| EUR | Deposit Facility Rate (Jul) | 14:45 | -0.50% | -0.50% |

| EUR | ECB Marginal Lending Facility | 14:45 | 0.25% | |

| EUR | ECB Monetary Policy Statement | 14:45 | ||

| EUR | ECB Interest Rate Decision (Jul) | 14:45 | 0.00% | 0.00% |

| USD | Initial Jobless Claims | 15:30 | 350K | 360K |

| EUR | ECB Press Conference | 15:30 | ||

| USD | Existing Home Sales (Jun) | 17:00 | 5.90M | 5.80M |

| Friday, July 23, 2021 | ||||

| GBP | Retail Sales (MoM) (Jun) | 09:00 | 0.50% | -1.40% |

| EUR | German Manufacturing PMI (Jul) | 10:30 | 64.1 | 65.1 |

| GBP | Composite PMI | 11:30 | 61.9 | 62.2 |

| GBP | Manufacturing PMI | 11:30 | 62.7 | 63.9 |

| GBP | Services PMI | 11:30 | 62 | 62.4 |

| RUB | Interest Rate Decision (Jul) | 13:30 | 6.00% | 5.50% |

| CAD | Core Retail Sales (MoM) (May) | 15:30 | -2.00% | -7.20% |

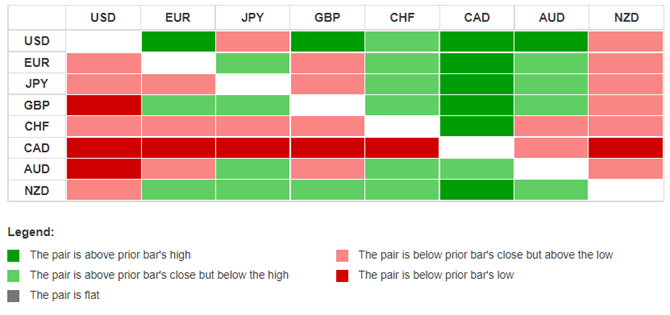

Daily Currency Heatmap

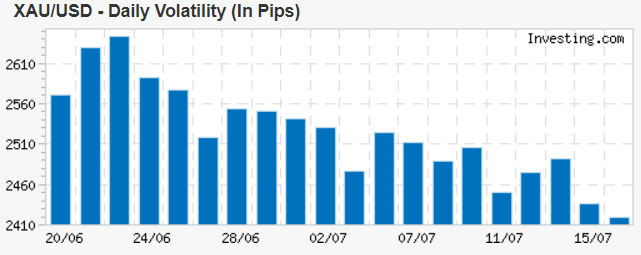

Gold is currently trading around the $1800 price level, since our last look at gold it tested the $1824 resistance as expected, temporarily moving above this level to reach a high of $1834 before retreating to the $1815-$1795 range. The Pivot Point for the current week is at $1812. The $1800 level still serves as a psychological support level. The key level of resistance is the $1824 level a break of this level may see gold rise to the $1850 - $1862 range. Our strong support is still in the $1750-$1747 area. Will we revisit the $1750 level before the precious metal continues to move higher?

*Source Investing.com Calculator

In the above table we can see the continuation of the decline in the gold volatility against the US dollar, since the last peak in volatility on the 23rd of June.

Stocks to Watch

Earnings: Below are the stocks to monitor for the rest of the week will announce their earnings.

| Monday, July 19, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | IBM (IBM) | 2.32 | 18.29B | 124.11B | Not Stated |

| Tuesday, July 20, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | Netflix (NFLX) | 3.18 | 7.32B | 235.14B | After Close |

| US | Philip Morris (PM) | 1.54 | 7.66B | 154.14B | Before Open |

| US | United Airlines Holdings (UAL) | -4.21 | 5.25B | 14.89B | After Close |

| UK | Ubisoft (0NVL) | -- | 333.75M | 6.86B | Not Stated |

| UK | EasyJet (EZJ) | - | 610M | 3.60B | Not Stated |

| Wednesday, July 21, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | J&J (JNJ) | 2.29 | 22.5B | 442.67B | Before Open |

| US | ASML ADR (ASML) | 2.98 | 4.87B | 282.50B | Before Open |

| US | Coca-Cola (KO) | 0.5615 | 9.3B | 243.18B | Before Open |

| US | Verizon (VZ) | 1.3 | 32.71B | 233.75B | Before Open |

| US | Texas Instruments (TXN) | 1.83 | 4.35B | 171.89B | Not Stated |

| US | Johnson Matthey (JMPLY) | - | - | 8.04B | Not Stated |

| US | Harley-Davidson (HOG) | 1.21 | 1.4B | 6.61B | Before Open |

| Thursday, July 22, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | Abbott Labs (ABT) | 1.02 | 9.69B | 208.79B | Before Open |

| US | AT&T (T) | 0.7937 | 42.66B | 202.35B | Before Open |

| UK | Unilever (ULVR) | 1.29 | 13.33B | 112.75B | Before Open |

| US | Twitter Inc (TWTR) | 0.072 | 1.06B | 53.00B | After Close |

| Friday, July 23, 2021 | Stock | EPS Forecast | Revenue Forecast | Market Cap | Time |

| US | NextEra Energy (NEE) | 0.6863 | 4.91B | 152.80B | Before Open |

| US | American Express (AXP) | 1.63 | 9.55B | 135.57B | Before Open |

| UK | Vodafone Group PLC (VOD) | - | 361.00M | 32.13B | Before Open |

Dividends: The following stocks will be paying dividends over this week.

| Monday, July 19, 2021 | Stock | Ex Div Date | Dividend | Type | Yield |

| US | Caterpillar (CAT) | Jul 19, 2021 | 1.11 | Quarterly | 2.10% |

| Tuesday, July 20, 2021 | Stock | Ex Div Date | Dividend | Type | Yield |

| US | Colgate-Palmolive (CL) | Jul 20, 2021 | 0.45 | Quarterly | 2.15% |

| US | NVIDIA (NVDA) | Jul 20, 2021 | 0.16 | Quarterly | 0.08% |

| Thursday, July 22, 2021 | Stock | Ex Div Date | Dividend | Type | Yield |

| UK | Investec (INVP) | Jul 22, 2021 | 13 | Trailing 12 Month | 4.58% |

| UK | Micro Focus (MCRO) | Jul 22, 2021 | 17.65 | Trailing 12 Month | 4.34% |

| US | Procter & Gamble (PG) | Jul 22, 2021 | 0.8698 | Quarterly | 2.50% |

| Friday, July 23, 2021 | Stock | Ex Div Date | Dividend | Type | Yield |

| US | Texas Instruments (TXN) | Jul 23, 2021 | 1.02 | Quarterly | 2.17% |

Market Holidays

Holidays: The following countries have national holidays this week.

| Date | Holiday | Time | Affected Markets |

| Tuesday, July 20, 2021 | |||

| Singapore | Hari Raya Puasa | All Day | Singapore Stock Exchange |

| Wednesday, July 21, 2021 | |||

| India | Bakri Id | All Day | India Stock Exchange |

| Thursday, July 22, 2021 | |||

| Japan | Marine Day | All Day | Japan Stock Exchange |

| Friday, July 23, 2021 | |||

| Japan | Sport Day | All Day | Japan Stock Exchange |