Market Update 22/12/2021

Brent and WTI post biggest gains in 15 weeks

Oil prices moving steady on Wednesday, with market players on the lookout for fuel demand pointers amid COVID-19 concerns after Singapore suspended quarantine-free travel and Australia renewed its vaccination push due to a surge in Omicron variant cases. If there are more countries deciding to take the same stance on travel bans due to new Covid-19 variant we may see a shift in the demand of Oil. U.S. West Texas Intermediate (WTI) crude futures rose 12 cents, or 0.1%, to $71.24 a barrel at 0757 GMT after jumping 3.7% on Tuesday. Brent crude futures rose 1 cent, or 0.01%, to $73.99 a barrel after gaining 3.4% in the last session.

Crude Oil

Brent Oil

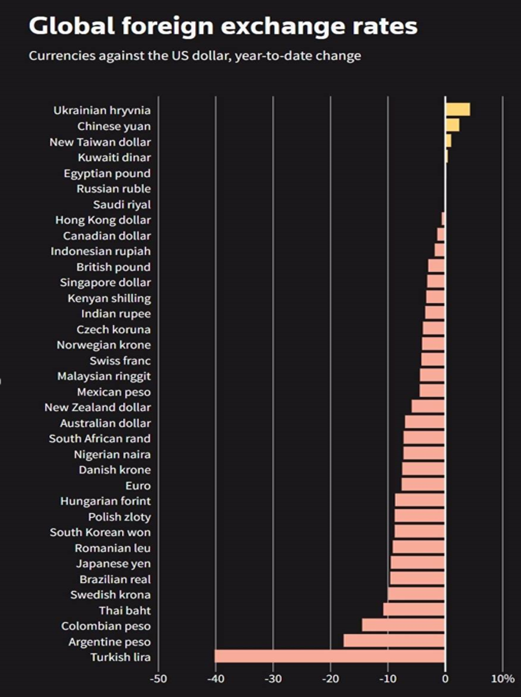

US Dollar Performance in 2021

Below we can see the performance of currencies vs multiple global currencies, only 4 currencies managed to outperform the Greenback (USD dollar) over this year.

Natural Gas

European gas prices hit a new record high on Tuesday after Yamal switched direction, a move the Kremlin said had no political implications, while two big German customers said Gazprom was meeting supply obligations. The European benchmark was trading at 177 euros ($199.92) per megawatt hour, close to the all-time high of nearly 185 euros hit in the previous session.

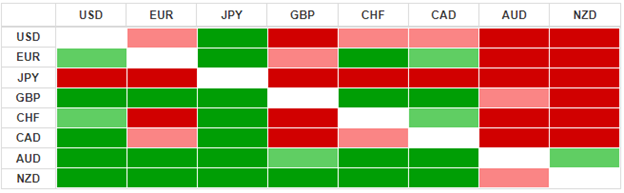

Daily Currency Heatmap

The table below shows the devaluation of the Japanese Yen against all the other major currencies. The Aussie and the Kiwi are both Bullish in comparison to the other ‘majors’.

Todays’ Earnings

| Monday, December 20, 2021 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | |

| UK | Nike | 0.6308 | 11.25B | 255.40B | |

| US | Micron | 2.1 | 7.68B | 92.97B | |

| US | H&R Block | -0.94 | 163.68M | 4.14B | |

| Tuesday, December 21, 2021 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | |

| US | General Mills | 1.05 | 4.83B | 40.98B | |

| US | FactSet Research | 2.99 | 419.37M | 17.81B | |

| US | BlackBerry | -0.0738 | 176.97M | 5.22B | |

| US | AAR | 0.5467 | 460.07M | 1.25B | |

| Wednesday, December 22, 2021 | |||||

| Country | Stock | EPS Forecast | Revenue Forecast | Market Cap. | |

| US | Cintas | 2.64 | 1.9B | 45.35B | |

| US | Paychex | 0.7974 | 1.06B | 44.67B | |

| US | CarMax | 1.47 | 7.28B | 22.30B | |

Today’s Dividends

| Monday, December 30, 2021 | ||||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Type | Yield |

| US | Ambev SA | 20/11/2021 | 0.023804 | USD | Twelve Months | 3.89% |

| US | Amphenol | 20/11/2021 | 0.2 | USD | Three Months | 0.97% |

| US | General Electric | 20/11/2021 | 0.08 | USD | Three Months | 0.35% |

| US | MEDIFAST | 20/11/2021 | 1.42 | USD | Three Months | 2.68% |

| US | Nordson | 20/11/2021 | 0.51 | USD | Three Months | 0.82% |

| US | Omnicom | 20/11/2021 | 0.7 | USD | Three Months | 3.83% |

| US | SEI | 20/11/2021 | 0.4 | USD | Six Months | 1.28% |

| Tuesday, December 21, 2021 | ||||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Type | Yield |

| US | Broadcom | 21/11/2021 | 4.1 | USD | Three Months | 2.58% |

| US | Medtronic | 21/11/2021 | 0.63 | USD | Three Months | 2.50% |

| US | Seagate | 21/11/2021 | 0.7 | USD | Three Months | 2.68% |

| US | Xcel Energy | 21/11/2021 | 0.4575 | USD | Three Months | 2.73% |

| Wednesday, December 22, 2021 | ||||||

| Country | Stock | Ex-Dividend Date | Dividend | Currency | Type | Yield |

| US | Aria | 22/12/2021 | 0.9 | USD | Three Months | 7.46% |

| US | ETV New York MBF | 22/12/2021 | 0.0378 | USD | One Month | 3.72% |

| US | Gladstone Land | 22/12/2021 | 0.0452 | USD | One Month | 1.76% |

| US | LTC Properties | 22/12/2021 | 0.19 | USD | One Month | 6.65% |

| US | Marriot Vacations Worldwide | 22/12/2021 | 0.54 | USD | Three Months | 1.44% |

| UK | Philip Morris | 22/12/2021 | 1.25 | GBP | One Month | 5.18% |

| UK | Putnam Municipal Opportunit Trust | 22/12/2021 | 0.0531 | USD | One Month | 4.39% |

| US | Ralph Lauren A | 22/12/2021 | 0.6875 | USD | Three Months | 2.39% |

| US | Sempra Energy | 22/12/2021 | 1.1 | USD | Three Months | 3.47% |